Xcel Brands, Inc.

$0.72 +0.0155 +2.21% 7.6K

Sidoti Issues Research Note on XCEL Brands (NASDAQ: XELB), Maintains $3 Price Target

Sidoti’s report on Xcel Brands (Nasdaq: XELB) cites an estimated $0.10 EPS in 2025 as a key driver behind its $3 price target for the media and consumer products company. Other notable drivers include: growth of fully owned brands, upcoming new brand launch on HSN in late 2024, and increasing market share for ORME, the company’s innovative social commerce platform.

Read the Report Here - 2024-07-25

Company Overview

Xcel Brands is a media and consumer products company engaged in the design, marketing, live streaming, and social commerce sales of branded apparel, footwear, accessories, fine jewelry, home goods and other consumer products, and the acquisition of dynamic consumer lifestyle brands. Xcel was founded in 2011 with a vision to reimagine shopping, entertainment, and social media as social commerce. Xcel owns the Judith Ripka, Halston, LOGO by Lori Goldstein, and C. Wonder by Christian Siriano brands and a minority stake in the Isaac Mizrahi brand. It also co-owns TWRHLL by Christie Brinkley and owns and manages the Longaberger brand through its controlling interest in Longaberger Licensing LLC.

Xcel is pioneering a next-generation media, live-streaming and social commerce company with a modern working capital light consumer products sales strategy which includes the promotion and sale of products under its brands through interactive television, digital live-stream shopping, social commerce, brick-and-mortar retail, and e-commerce channels to be everywhere its customers shop. The Company’s brands have generated in excess of $4 billion in retail sales via livestreaming in interactive television and digital channels alone. Headquartered in New York City, Xcel Brands is led by an executive team with significant live streaming, production, merchandising, design, marketing, retailing, and licensing experience, and a proven track record of success in elevating branded consumer products companies.

Value Proposition

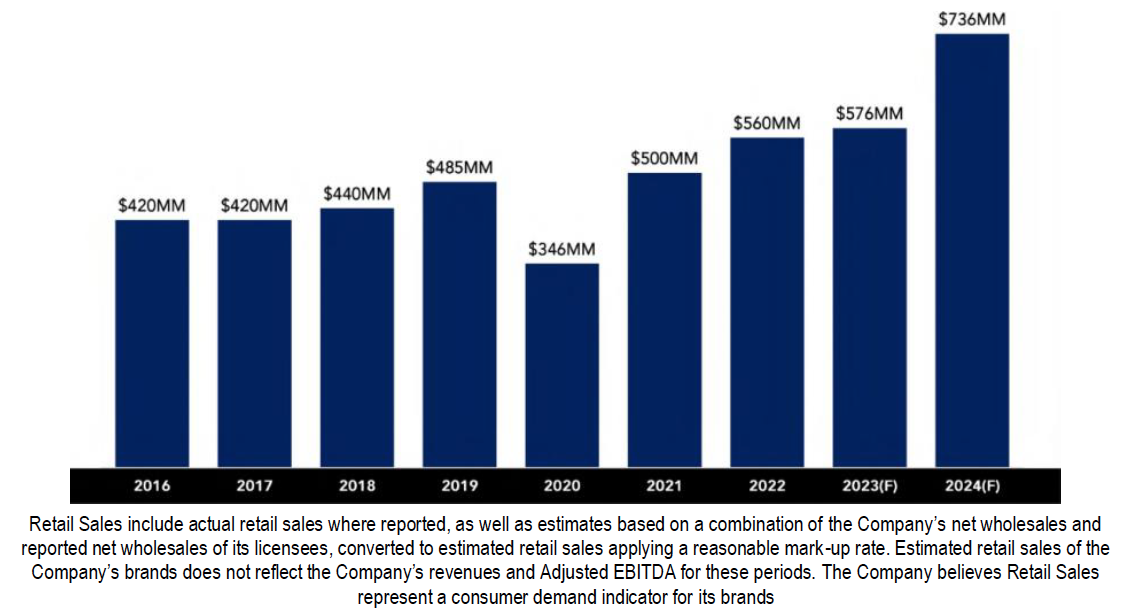

Xcel Brands is a pioneering force in the convergence of shopping, entertainment, and social media and expects to generate $18 million in top-line royalty revenue in 2024. Based on the recent sale of 70% interest in its Isaac Mizrahi brand, which sold for six times royalty revenue, Xcel is trading for a greater than 75% discount to its intrinsic value, presenting tremendous potential upside for investors. Social commerce is expected to drive 20% of all US online sales by 2026, and Xcel is perfectly positioned to capture a significant market share with its proven approach to increasing conversion rates that significantly outperforms traditional digital marketing strategies. The Company's brands boast over 6 million social followers, generate over $600 million in annual retail sales, and have delivered over 20,000 hours of live-stream programming.

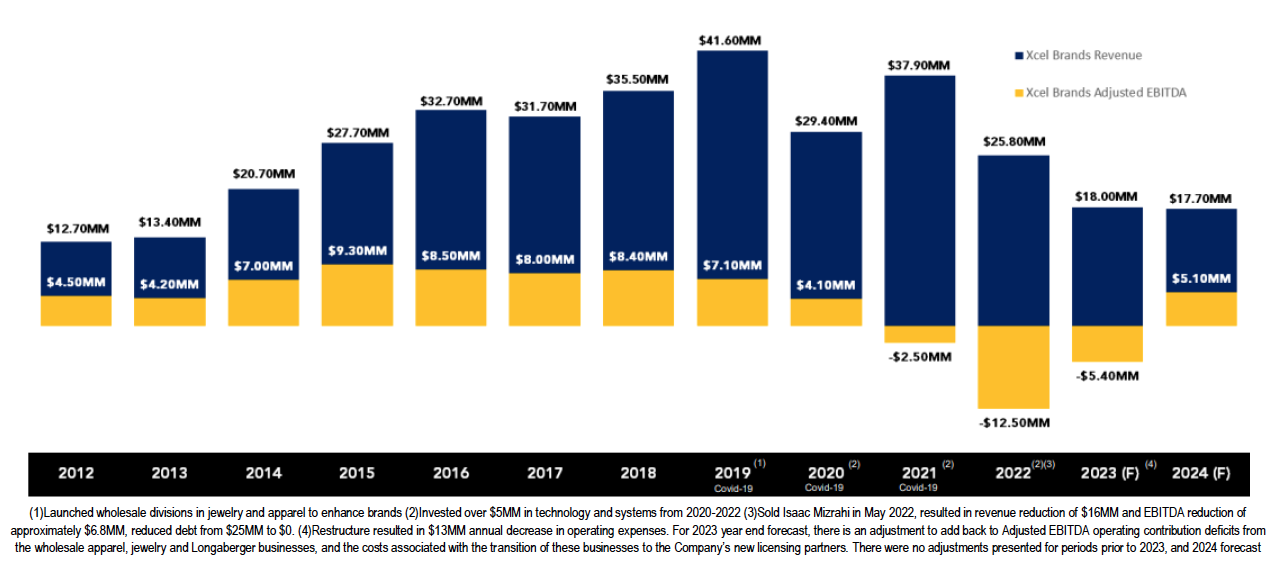

Operating on a working capital-light business model, Xcel has a historical track record of revenue growth with positive adjusted EBITDA (pre-COVID), allowing for continued investment in brand and technology development. With the launch of its new proprietary live stream and social commerce platform, Orme, Xcel is set for strong cash flow generation starting in Q1 2024. The Company's management team, which holds over 60% of Xcel's outstanding shares, brings decades of experience in building major brand management companies, and they are committed to driving innovation and profitability. In summary, Xcel presents a unique investment opportunity, combining leadership in an emerging industry, innovative technology, creative excellence, financial resilience, and strong growth prospects.

Sales at Retail

XCEL OWNS STRONG BRANDS THAT RESONATE WITH CONSUMERS

Investor Presentation

Investment Highlights

- Strong Brand Presence

- 6+ million social media followers across brands

- Brands generate $600+ million in annual retail sales

- Delivered 20,000+ hours of live-stream content

- Pioneer in Emerging Social Commerce Industry

- Poised to capture significant market share in social commerce; social commerce projected to account for 20% of all US online sales by 2026

- Launch of proprietary ORME social commerce marketplace platform set to transform consumer product sales; XELB owns 30% interest in ORME

- Efficient Operational Model

- Working capital light business model with a track record of delivering revenue growth and positive adjusted EBITDA

- Well positioned for future growth and profitability

- Experienced Management Team

- Significant expertise in building major brand management companies

- Insiders own 60%+ of outstanding shares

- Undervalued

- Recently sold 70% interest in Isaac Mizrahi brand for 6x royalty revenue; applying similar valuation metric to Xcel’s projected $18 million top-line royalty revenue for 2024, the Company is trading at >75% discount to its intrinsic value

Revenue and Adjusted EBITDA