ASP Isotopes

$2.75 +0.0500 +1.85% 734.3K

Company Overview

ASP Isotopes is an isotope enrichment company utilizing technology developed in South Africa over the past 20 years to enrich isotopes of elements or molecules with low atomic masses. Many of these elements are unsuitable for enrichment using traditional methods such as centrifuges. The Company’s initial focus is on producing and commercializing highly enriched isotopes for the healthcare and technology industries.

Value Proposition

ASP Isotopes harnesses two decades of research and development to produce a broad range of isotopes, serving the expanding needs of nuclear medicine and green nuclear energy sectors. The Company's cutting-edge technology positions it to meet critical global demands heightened by recent geopolitical dynamics.

With cold commissioning completed at its first plant and several strategic off-take agreements in place, ASP Isotopes is on track to become a leader in non-nuclear isotope supply by 2028. Noteworthy agreements include a $27 million annual contract with BRICEM for Molybdenum-100, a $3.8 million annual deal for Carbon-14 with a Canadian firm, and a significant $9 million agreement with a U.S. customer, with initial deliveries expected in Q1 2024.

Financially, the Company is well-positioned with a robust balance sheet, highlighted by no long-term debt and significant cash reserves. Despite early-stage losses, ASP Isotopes is poised for substantial revenue growth, with expectations of impactful revenue starting in the first half of 2024 as it ramps up commercial production.

HC Wainwright recently reaffirmed its buy rating on ASP Isotopes, raising the price target to $5.50 based on the Company’s advanced de-risking measures and promising revenue prospects. This robust outlook, combined with strategic expansions and innovative operational strategies, underscores ASP Isotopes' strong potential for sustained growth and value creation for its shareholders.

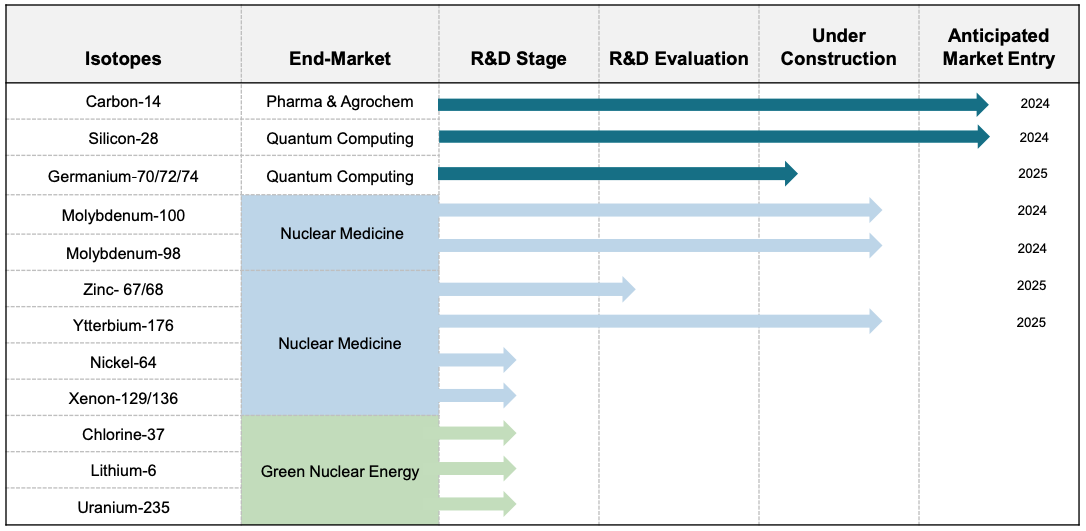

Development Pipeline

Medical

Semiconductors

Investor Presentation

Investment Highlights

-

Signed 25-year supply agreement valued at up to $27 million per annum

- Agreement for highly enriched Molybdenum-100 (Mo-100) with BRICEM (Beijing Research Institute of Chemical Engineering Metallurgy)

-

Signed multi-year supply agreement targeting $3.8 million revenue per annum

- Agreement for highly enriched Carbon-14 (C-14) with RC-14, a Canadian company

- Initial contract term is two years and can be extended to 10 years

-

Signed $9 million supply contract with US customer

- Received first prepayment in Q3 2023 of approximately $900,000; commercial supply of enriched isotope projected for Q1 2024

-

Signed two MOUs with small modular reactor companies to supply High Assay Low Enriched Uranium (HALEU)

- Created new subsidiary, Quantum Leap Energy LLC, to supply commercial quantities of HALEU

- $30 billion of HALEU demand expected based on initial discussions with customers

-

ASP technology is a low capital cost and environmentally friendly method of isotope production

- Enrichment facilities using ASP tech can be constructed at a fraction of cost and time vs traditional facilities with small footprint plants and modular design enabling capacity expansion

- ASP technology harvests and enriches a natural mix of isotopes without need for nuclear reactor by-products; ASP plant produces zero waste (not radioactive nor any other waste in any form)

-

Geo-political uncertainty and plant phase-outs create significant opportunity

- Planned phase-out of 9 of 10 old research nuclear reactors over next decade creates large shortfall in the global supply for Mo-99 and other isotopes

- Russia and China previously key global suppliers of isotopes; recent geopolitical events have forced governments and other customers to reassess their reliance on these suppliers

-

Highly Experienced Leadership Team

- Paul Mann, Co-Founder, Chairman, CEO, CFO; 20+ years’ experience on Wall Street investing in healthcare and chemicals companies, having worked at Soros Fund Management, Highbridge Capital Management and Morgan Stanley; began career as a research scientist at Proctor & Gamble

- Hendrik Strydom, PhD, Director, CTO; 30+ years’ experience in isotope enrichment; co-developed isotope separation technology that is backbone of ASP Isotopes

- Buy rating & $5.50 per share price target from HC Wainwright (coverage initiated in December 2023; PT updated in April 2024)

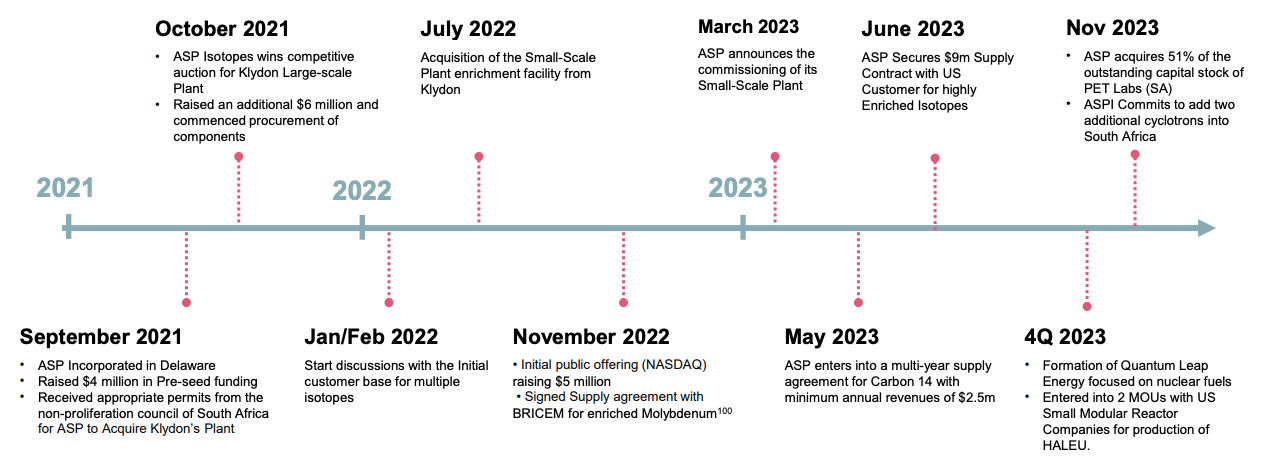

Rapidly Advancing Operations