$0.65 -0.02 ( -3.32% ) 415.8K

NASDAQ: SPEC

Company Overview

Spectaire Holdings (Nasdaq: SPEC) represents a pioneering leap in environmental technology with its flagship AireCore system, a game-changer in emissions measurement and management. This innovative system, which includes a cutting-edge emissions measurement device, encrypted cloud storage, and intuitive desktop/mobile applications, offers a comprehensive solution for tracking and reducing carbon footprints at a fraction of the cost of traditional methods.

With a business model combining upfront low-cost hardware sales with recurring service revenues, Spectaire is set to democratize access to mass spectrometry, mirroring the transformative shifts seen from mainframes to laptops and landlines to cellular phones.

The Company's technology has garnered significant interest, evidenced by substantial orders and pilots from major industry players like Nabors (NYSE: NBR), highlighting Spectaire's potential to revolutionize emissions management across sectors. Backed by a seasoned management team with a track record of technological innovation and commercial success, Spectaire is well-positioned to lead the market in emissions mitigation strategies, offering a lucrative opportunity for investors looking to contribute to a sustainable future while achieving substantial returns.

Value Proposition

In the rapidly evolving environmental technology sector, Spectaire is positioned as a compelling opportunity with its disruptive AireCore system—a cutting-edge innovation in emissions measurement and management. Spectaire’s pioneering approach aims to solve a critical global challenge: the efficient and accurate tracking of emissions. At a time when environmental concerns are at the forefront of global policy and corporate responsibility, Spectaire's technology offers a much-needed solution that is both cost-effective and scalable, contrasting sharply with the prohibitively expensive and cumbersome options currently dominating the market.

Spectaire has captured interest from key industry players, including Nabors (NYSE: NBR), an oil and gas drilling contractor with the largest land drilling fleet in the world. Spectaire has signed a purchase order for 500 units (at $2,000/unit) and has the potential to order an additional 1,500 units. The annual recurring services revenue potential from the current 500-unit PO with NBR is estimated at $5 million ($10,000/unit per year). Spectaire’s sales pipeline includes pilots and prospective pilots with UPS, Bison Trucking, and Pacific Northwest National Labs (PNNL).

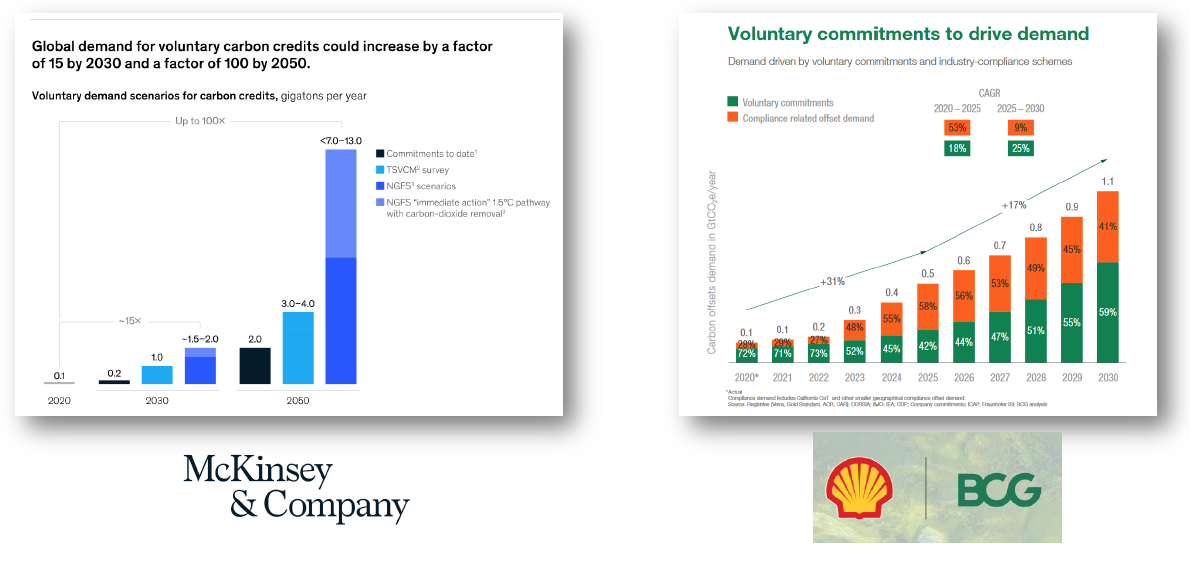

Spectaire's strategic position in the burgeoning carbon credits market enhances its investment thesis. As the world gravitates towards net-zero targets, the demand for verifiable, permanent carbon credits is surging—an arena where Spectaire's technology can play a pivotal role. By enabling precise emissions tracking and the generation of technology-based carbon credits, Spectaire addresses a critical need, opening additional revenue streams and further solidifying its market position.

Backed by an experienced management team with a proven track record in technology innovation and market scaling, Spectaire is well-equipped to navigate the complexities of growth and competition. In a world increasingly driven by both technological advancement and environmental consciousness, Spectaire represents a unique blend of growth potential, market relevance, and societal impact, making it a compelling choice for the savvy investor.

Exponential Growth Projected for Verified Carbon Standard (VCS) Market

Market Data

Investment Highlights

-

Innovative emissions measurement technology

- Proprietary AireCore system revolutionizes emissions tracking through miniaturized system with high accuracy and lower costs

- Comprehensive solution with device, encrypted cloud storage, and desktop/mobile applications

- Significant cost and size advantage over traditional methods (AireCore system at $3,000 vs. competitors at $100,000+)

-

Significant market potential and expanding sales pipeline

- Positioned in a rapidly growing Air Quality Monitoring Systems (AQMS) market valued at $5 billion in 2021

- Anchor customers include: Nabors (NYSE: NBR) - signed purchase order (500 units at $2,000/unit with $10,000 annual recurring revenue per unit); and Mosolf – signed purchase order (300 units)

- Diverse customer pipeline across sectors with verbal commitments and ongoing pilots (including prospective pilot with UPS: 10 units with 126,000 unit potential)

-

Technology supports the generation of verifiable carbon credits

- AireCore enables daily savings vs. baseline tracking, vital for accurate carbon credit calculation

- Meets growing demand for carbon credits with public net-zero targets

-

Robust financial model and growth trajectory

- Manufacturing capacity set for significant scaling (10,000 units annually would generate $50 million in annual hardware and services revenue with an estimated $19 million EBITDA)

-

Highly experienced management team

- Leadership team with proven expertise in technology development, scaling, and market penetration