$1.42 -0.01 ( -0.70% ) 28.6K

NYSE AMERICAN: UMAC

Company Overview

Unusual Machines is focused on becoming a first-person view (FPV) drone technology market leader. Simultaneously with the closing of the IPO, the Company plans to acquire Fat Shark which is the leader in FPV, designing and manufacturing ultra-low latency video goggles for drone pilots, as well as Rotor Riot which is a rapidly growing ecommerce marketplace, backed by the largest community of FPV drone pilots in the world. The closing of the acquisitions is part of our vision to enable people to be part of the robotics revolution. Headquartered in Puerto Rico, the Company is bringing together great teams, valuable IP, and high-quality brands, in order to become a leader within the highly fragmented drone industry.

Value Proposition

Unusual Machines is gathering great teams, revenue generating customers, valuable IP, and high-quality brands, growing both organically and through strategic acquisitions within the highly fragmented drone industry. The Company is focused on investing in the development or acquisition of FPV products and services that serve a broad set of industries including consumer, public safety, and drone delivery. The Company’s Fat Shark and Rotor Riot subsidiaries are setting the standard for FPV immersive experiences and are expected to continue to corner the consumer FPV market as Unusual Machines expands into new enterprise verticals over the next 24 months. As Unusual Machines capitalizes on the wealth of opportunities in the rapidly evolving drone market it is well positioned for long-term success.

Market Data

Investment Highlights

- Expanding portfolio of drone technology solutions through consolidation of highly fragmented drone industry

- Acquisitions of Fat Shark and Rotor Riot create strong initial position

- Targeting additional acquisitions that are cash flow positive and complement retail sales or component initiatives

- US-based development and assembly provides strong competitive advantage

- Made-in-USA extremely attractive amid national security concerns

- Regulatory and DoD procurement provide for major immediate growth drivers

- IP protections

- 12 patents issues and 8 patents pending; includes US, EU, Korea, Canada, China, Japan, and UK

- Addressing a global opportunity

- Consumer drones forecasted to grow to $20 billion by 2030, a 20.8% CAGR

- Drone components market was valued at $15 billion in 2022, growing at a 11.4% CAGR to $28 billion in 2028

- Highly experienced leadership team

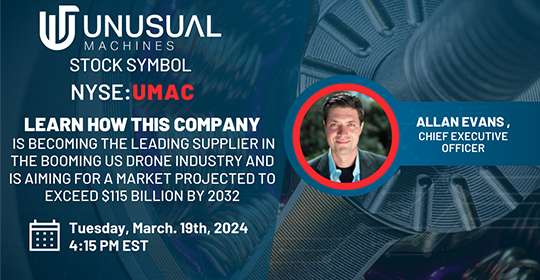

Archived Webinar

RedChip Investor Group Call with Unusual Machines (NYSE AMERICAN: UMAC)

Date: Tuesday, March 19, 2024