$3.10 +0.2300 ( +8.07% ) 17.6K

NASDAQ: LOBO

Company Overview

LOBO EV, headquartered in Wuxi, China, is a pioneering OEM and ODM manufacturer and seller of electric vehicles (EVs), including e-bicycles, e-mopeds, e-tricycles, and electric off-highway four-wheeled shuttles, tailored for various demographics, including mobility solutions for the elderly and disabled. Beyond vehicle manufacturing, LOBO EV offers automobile information and entertainment software development services to industry OEMs. The Company has a proven track record of leveraging advanced technologies in connectivity, multimedia, interactive systems, and artificial intelligence to enhance user experience with affordable, convenient, and enjoyable driving solutions. Holding a robust position in the market, LOBO EV is distinguished by its Alibaba.com 'golden plus' supplier status and its certification as an Excellent Company by the China Business Credit Platform, signaling its commitment to quality and innovation in the electric vehicle industry.

Value Proposition

LOBO EV presents an attractive value proposition underpinned by its strategic growth initiatives and solid performance across key segments. With an established track record and a focus on becoming an OEM and ODM leader in the intelligent urban tricycles and off-highway four-wheeled electric vehicles (EVs) market over the next decade, LOBO EV is poised for significant growth. The Company is executing a robust strategy that includes continuous innovation and new product launches, enhancing customer relationship management, diversifying marketing approaches, and stringent cost control measures. These efforts, aimed at capitalizing on the burgeoning demand for e-bikes, positions LOBO EV for long-term success in high-growth segments.

In FY 2022, the Company generated substantial revenue growth with its two-wheeled e-bike segment, which accounted for 56% of overall sales, contributing RMB 69 million (USD $10.3 million) in revenue, up from RMB 48 million (USD $7.4 million) in the previous year. This performance, coupled with strategic inroads in the three-wheeled EV market, which generated RMB 14 million (USD $2.1 million), and off-highway four-wheeled EVs, which generated revenues of RMB 7 million (USD $1.1 million) in FY 2022, up from RMB 0.6 million (USD $91,000) in 2021, highlight the ability of the Company to tap into high-growth market segments.

LOBO EV is navigating a path toward market leadership in these segments, supported by its innovative product offerings and strategic market positioning. The Chinese e-bike market, currently valued at $16 billion, is forecasted to nearly double, reaching $31.3 billion in the next five years with a compound annual growth rate (CAGR) of 11.76%, according to Research and Markets. This strong growth trajectory indicates a burgeoning demand for e-bikes in China, driven by increasing consumer preference for eco-friendly and cost-effective transportation solutions. The Company's robust financial performance across its key segments, coupled with the vast market opportunities within China's EV industry, position LOBO EV for significant upside.

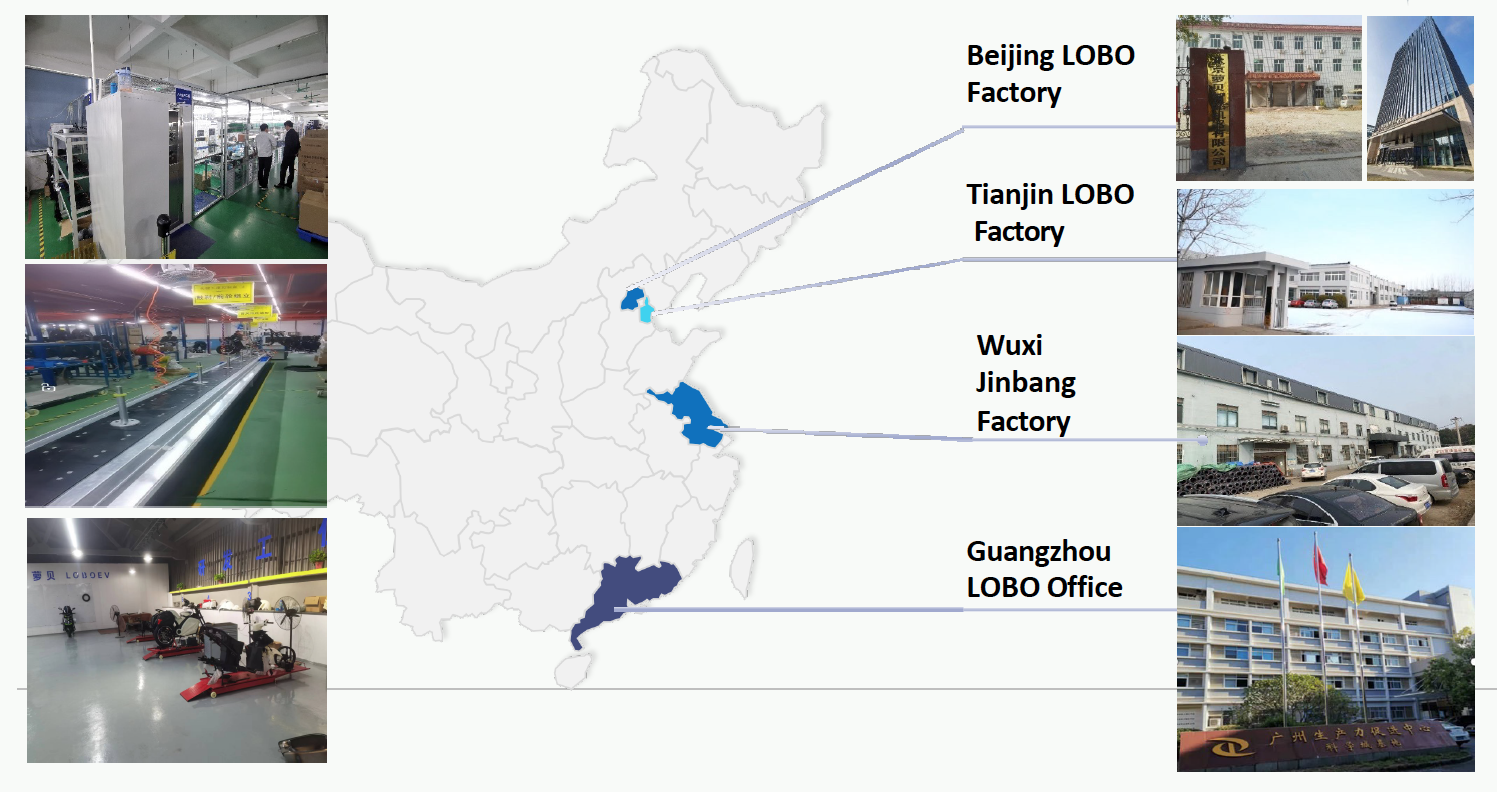

Established OEM & ODM Manufacturing Facilities

Market Data

Investment Highlights

-

Established track record of performance and proven strategic growth initiatives

- Established track record with a focus on becoming an OEM and ODM leader in intelligent urban tricycles and off-highway four-wheeled EVs

- Driving growth through continuous innovation, new product launches, and enhancing customer relationship management

- Diversification of marketing approaches and stringent cost control measures

-

Capitalizing on multiple high-growth segments

- Two-wheeled e-bike segment

- Accounted for 56% of overall sales in FY 2022

- Generated RMB 69 million (USD $10.3 million) in revenue in FY22, marking substantial growth from RMB 48 million (USD $7.4 million) in FY21

- Three-wheeled e-trike market

- Generated RMB 14 million (USD $2.1 million) in FY22

- Off-highway four-wheeled EVs

- Revenue of RMB 7 million (USD $1.1 million) in FY22, up significantly from RMB 0.6 million (USD $91,000) in 2021

- Two-wheeled e-bike segment

-

Large market opportunity

- Chinese e-bike market currently valued at $16 billion, with a forecast to reach $31.3 billion in the next five years (11.76% CAGR)

- Global tricycle and quadricycle markets estimated to growth from $8.2 billion in 2024 to $13.7 billion in 2029 (10.84% CAGR)

-

Strong leadership

- Guided by a visionary management team committed to steering the company towards capturing emerging opportunities within the massive EV market