$1.44 +0.0300 ( +2.07% ) 58.1K

NASDAQ: ENLV

Company Overview

Enlivex is a clinical stage macrophage reprogramming immunotherapy company developing AllocetraTM, a universal, off-the-shelf cell therapy designed to reprogram macrophages into their homeostatic state. A primary immune cell. Diseases such as sepsis, osteoarthritis and many others reprogram macrophages out of their homeostatic state. These non-homeostatic macrophages contribute significantly to the severity of the respective diseases. By restoring macrophage homeostasis, Allocetra™ has the potential to provide a novel immunotherapeutic mechanism of action and resolution for conditions which are life-threatening and debilitating “unmet medical needs”.

Value Proposition

Enlivex presents a compelling investment opportunity in the biopharmaceutical sector with its innovative approach to treating life-threatening and debilitating conditions through macrophage reprogramming. The company's leading product, Allocetra™, is a groundbreaking, off-the-shelf cost-effective cell therapy platform designed to reset the body's immune cells (macrophages) to their optimal functioning state. This technology addresses a critical need for rebalancing the immune system, offering potential treatments for a range of inflammatory and autoimmune diseases with high unmet medical needs. With macrophages playing a vital role as the body's first line of defense, Enlivex's focus on converting these cells from a "disease setting" back to their "resolution settings" opens the door to addressing complex conditions like sepsis and osteoarthritis, tapping into multi-billion-dollar markets.

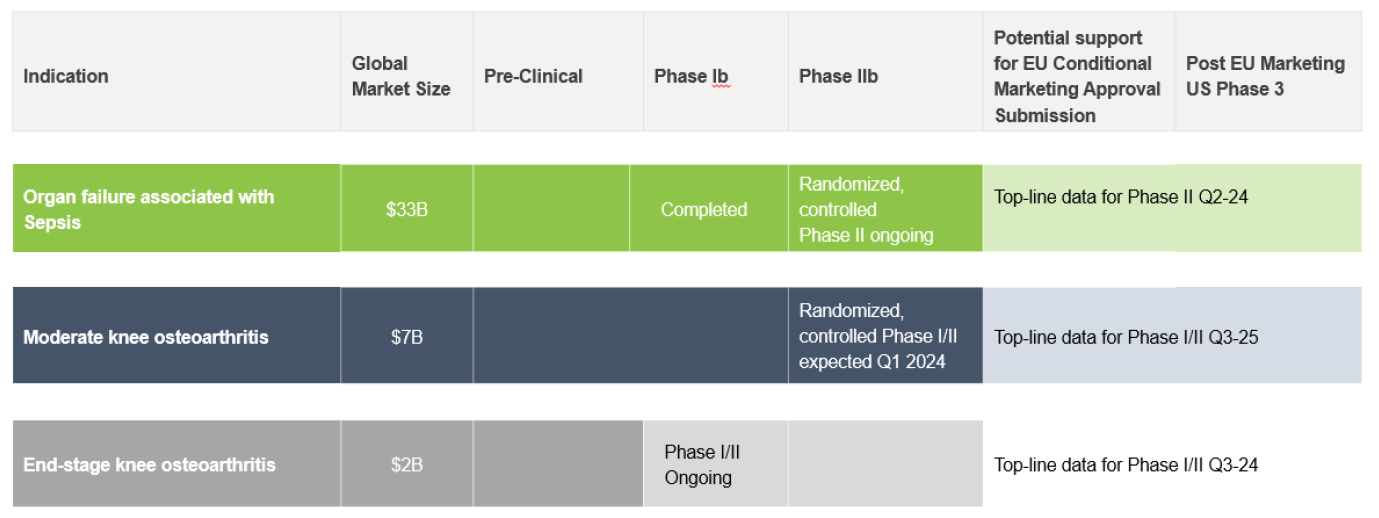

The Company is at an advanced clinical stage, with Phase IIb trials for sepsis showing promise for a $33 billion market opportunity and Phase I/II trials in osteoarthritis aiming at a combined market opportunity of $9 billion. Additionally, the prospect of a short regulatory approval pathway in Europe for its sepsis treatment enhances the value proposition for investors. Enlivex's strong leadership team, proven by their successful $560 million exit event with PROLOR Biotech and a significant partnership with Pfizer, underscores the company's potential for high returns. With a robust cash balance and plain vanilla capital structure ensuring operational runway through the end of 2025 and a buy recommendation with a $12 per share price target, Enlivex stands out as a promising investment for investors seeking to capitalize on the next wave of innovations in immunotherapy and cell reprogramming technologies.

Pipeline

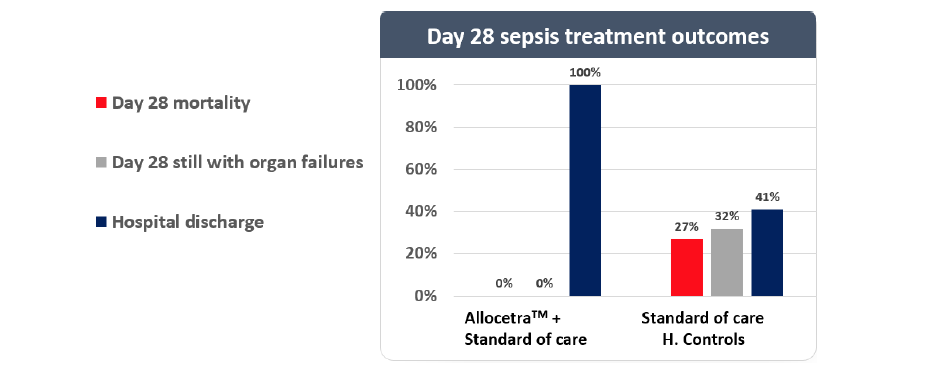

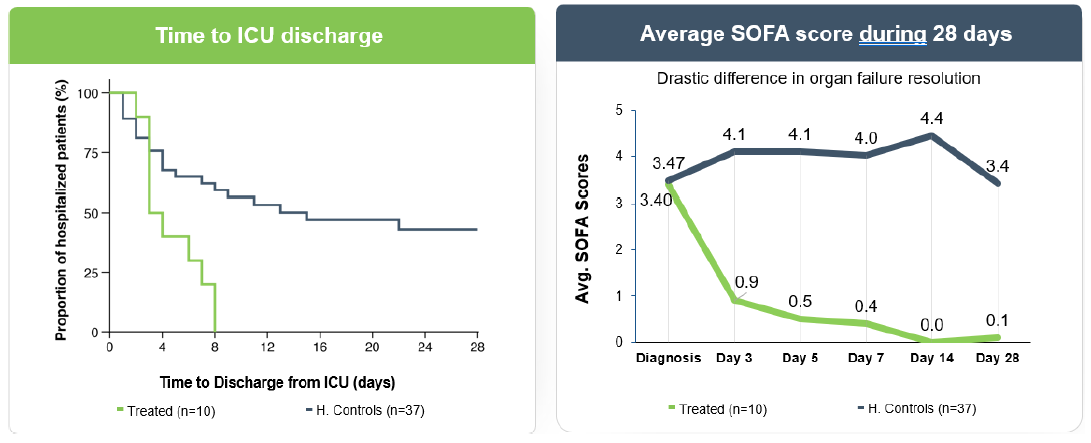

Allocetra™ macrophage reprogramming leads to improved outcomes for sepsis patients

Statistically significant improvement in hospitalization and SOFA vs. matched controls

Market Data

Investment Highlights

- Macrophage reprogramming targeting unmet medical need indications

- Off-the-shelf, universal cell therapy for resetting macrophages back to their ”resolution settings” and away from “disease settings”

- A type of immune cell, macrophages act as the body's first line of defense, engulfing and destroying pathogens and debris

- Resetting non-homeostatic macrophages into their homeostatic state is critical for immune system rebalancing and resolution of life-threatening conditions

- Advanced clinical-stage pipeline addressing multi-billion-dollar markets

- Phase IIb macrophage reprogramming for sepsis

- Data readout anticipated by end of Q1 2024; $33B global market opportunity

- Phase I/II in osteoarthritis (OA)

- Top-line data for end-stage knee osteoarthritis expected in Q2 2024; $2B global market opportunity

- Top-line data readout from moderate knee osteoarthritis expected in Q2 2025; $7B global market opportunity

- Favorable pharmacoeconomic model for local OA injection, translates into a highly competitive product pricing for this unmet medical need indication

- Short regulatory approval pathway

- Specialized regulation in Europe potentially enabling post-Phase II marketing approval in sepsis

- Strong leadership

- Previously founded and managed PROLOR Biotech; a $560M exit event; signed partnership with Pfizer, including $295 million down payment; and drug (NGenla) approved in 43 countries (incl. US); leading product in $4 billion market

- Vice Chairman Roger Pomerantz: former Head of Business Development at Merck and former Venture Parter at Flagship Pioneering

- Cash balance supporting multiple clinical milestones within 18-24 months

- $30.5 million cash (as of Sept. 30, 2023) provides runway through year end 2025

- Buy recommendation from H.C. WAINWRIGHT & CO with $12 per share price target

Archived Webinar

RedChip Investor Group Call with Enlivex Therapeutics (NASDAQ: ENLV)

Date: Thursday, March 21, 2024