$1.28 -0.01 ( -0.77% ) 131.7K

NASDAQ: BTCY

Company Overview

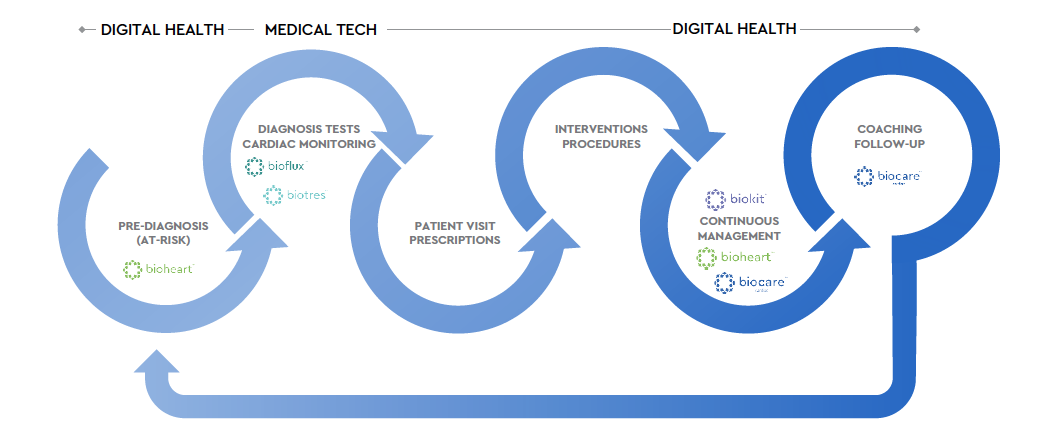

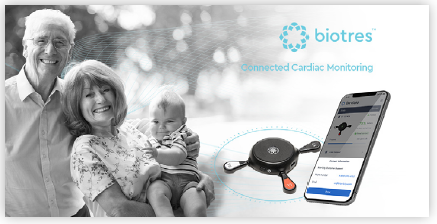

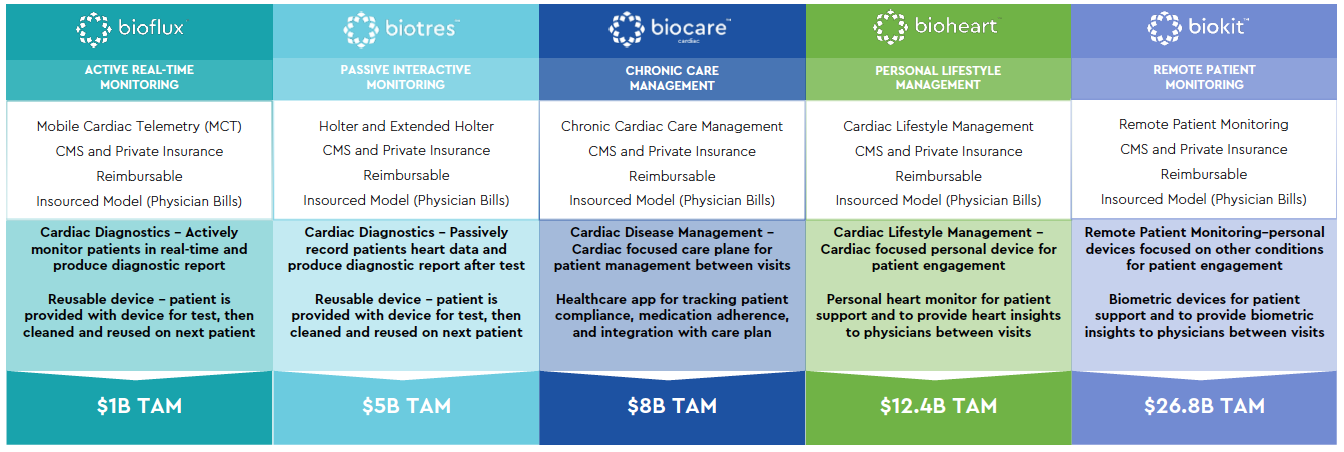

Biotricity is a pioneering medical technology company delivering a full suite of remote diagnostic and remote patient monitoring hardware solutions which integrate with powerful and proprietary software solutions to deliver state-of-the-art cardiac care to patients. Leveraging a technology-as-a-service model, our innovative product portfolio, which includes our FDA-cleared Bioflux® and Biotres devices, addresses a total addressable market of $35 billion.

Strategic contracts with leading Group Purchasing Organizations (GPOs) and Integrated Delivery Networks (IDNs) position us for rapid market penetration and growth. At the core of our expansion strategy is the advancement of our proprietary AI technology to deliver award-winning, best-in-class predictive monitoring tools that pave the way for groundbreaking disease profiling, enhanced patient management, and a transformative approach to disease prevention.

Value Proposition

Biotricity is revolutionizing cardiac care with its cutting-edge remote diagnostic and monitoring solutions that cater to a $35 billion total addressable market opportunity. By integrating advanced hardware and proprietary software, Biotricity has established a new paradigm in cardiac care. The Company’s robust technology platform and product ecosystem, featuring FDA-cleared smart cardiac monitors, coupled with a comprehensive cloud ecosystem, ensure seamless management of patient health across all stages of cardiac care. Utilized daily by cardiologists across 34 states and 500 centers, Biotricity has captured an 8% market share in cardiology, bolstered by a remarkable 99.2% retention rate and an LTV/CAC ratio of 9.

Biotricity reported record margins of 69% in FY2Q24 and expects margins to improve to 80% in the near-term. The Company’s revenue run rate, which was $14 million as of September 30, 2023, is expected to increase to $20 million over the next 12 months as Biotricity’s strategic partnerships with leading Integrated Delivery Networks (IDNs) and Group Purchasing Organizations (GPOs) are set to accelerate growth. Significantly, 93% of the Company’s trailing 12-month revenue is recurring, thanks to its technology-as-a-service model, paving a clear path to profitability with positive EBITDA anticipated in the next six months. Biotricity’s leadership team has over 100 years of collective startup experience and a proven track record of successfully launching 70+ products in over 30 countries. With its strong technological foundation, clear path to profitability, strategic market positioning, and experienced leadership, Biotricity represents a compelling value proposition for investors seeking to capitalize on the rapidly evolving medtech space.

Market Data

Investment Highlights

- Robust Technology Platform and Product Ecosystem

- Smart cardiac monitors and comprehensive cloud ecosystem designed to manage patient health seamlessly across various stages of cardiac care, from diagnostics to chronic disease management

- Proprietary FDA-approved cardiac monitoring solutions, including the Bioflux and the newly launched Biotres, are utilized daily by cardiologists across 34 states and 500 cardiology centers

- Holds an 8% market share in cardiology, supported by a 99.2% retention rate and a Lifetime Value to Customer Acquisition Cost (LTV/CAC) ratio of 9

- Strong margins and double-digit revenue growth

- Record margins of 69% in FY2Q24; margins expected to improve to 80%

- $14 million run rate as of September 30, 2023; expected to reach $20 million over next 12 months.

- 93% of revenue is recurring through technology-as-a-service model

- Clear path to profitability; positive EBITDA expected over next six months

- Positioned for rapid market expansion

- Partnerships with leading Integrated Delivery Networks (IDNs) and Group Purchasing Organizations (GPOs) anticipated to drive accelerate growth over next 12-18 months

- Current reach includes 2,500 physicians providing access to six million patients

- Product ecosystem expansion increased TAM from $1B to $35B in 2023

- Devices and services are insurance reimbursable, including Medicare, en suring accessibility to patients without out-of-pocket expenses

- Strong leadership

- 100+ years of collective startup experience

- Proven record of raising $100M+ capital across multiple companies/ industries

- Executive team has experience developing 70 products successfully launched in 30+ countries

Platform Solutions: Diagnosis to Management