| Can-Fite (NYSE American: CANF) Completes 50% Patient Enrollment in Its Phase III Psoriasis Trial |

| |

|

Can-Fite BioPharma (NYSE American: CANF), a biotechnology company with a pipeline of proprietary small molecule drugs that address inflammatory, cancer and liver diseases, completed enrollment of over 50% of the 407 patients planned for its Phase III Comfort™ trial to evaluate its drug candidate Piclidenoson in the treatment of moderate-to-severe plaque psoriasis.

Why It Matters: The Comfort™ Phase III psoriasis study is designed to establish Piclidenoson’s superiority compared to placebo and non-inferiority compared to Apremilast (Otezla®) in patients with moderate to severe plaque psoriasis.

The randomized, double blind study is being conducted in Europe, Israel, and Canada. The study’s primary end point is the proportion of subjects who achieve a PASI score response of ≥75% (PASI 75) vs. placebo at week 16. The secondary endpoints include non-inferiority to Otezla® on weeks 16 and 32.

Key Quote: “With just over half the patients enrolled in this pivotal Phase III study, we have achieved an important milestone. We look forward to completing enrollment and announcing topline results. We believe Piclidenoson is a potentially efficacious drug that can be safely used long-term on a daily basis by patients for chronic conditions.” – Dr. Pnina Fishman, CEO

The Backstory: CANF’s lead drug candidate, Piclidenoson, is currently in Phase III trials for rheumatoid arthritis and psoriasis. CANF’s liver cancer drug, Namodenoson, recently completed a Phase II trial for hepatocellular carcinoma (HCC), the most common form of liver cancer, and is in a Phase II trial for the treatment of non-alcoholic steatohepatitis (NASH). Namodenoson has been granted Orphan Drug Designation in the U.S. and Europe and Fast Track Designation as a second line treatment for HCC by the U.S. Food and Drug Administration. Namodenoson has also shown proof of concept to potentially treat other cancers including colon, prostate, and melanoma. CF602, the Company's third drug candidate, has shown efficacy in the treatment of erectile dysfunction in preclinical studies and the Company is investigating additional compounds, targeting A3AR, for the treatment of sexual dysfunction. These drugs have an excellent safety profile with experience in over 1,000 patients in clinical studies to date.

Disclosure

Can-Fite Biopharma (CANF) is a client of RedChip Companies, Inc. CANF agreed to pay RedChip Companies, Inc. a cash fee of $5,000 monthly, beginning in August 2019, and 16,500 shares of CANF Rule 144 stock for 6 months of RedChip investor awareness services and consulting services.

|

|

| |

|

| Piedmont Lithium (NASDAQ: PLL) Appoints Hatch to Deliver PFS for Lithium Hydroxide Project in North Carolina |

| |

|

Piedmont Lithium (NASDAQ: PLL) awarded the prefeasibility study (PFS) of its lithium hydroxide chemical plant in Kings Mountain, North Carolina to Hatch. Hatch is a global leader in the development of lithium conversion projects with notable experience including the full EPCM delivery of the Galaxy/Tianqi (Jiangsu) lithium conversion plant in China, the current detailed design engineering for two other spodumene to hydroxide plants, and of one brine conversion plant, in varied locations. Hatch has also studied lithium chemical projects for Mineral Resources (Australia), Kidman/Covalent (Australia), Desert Lion (Namibia), Savannah Resources (Portugal), among many others.

Why It Matters: Bench-scale lithium hydroxide conversion testwork is ongoing at SGS Labs in Lakefield, Ontario. Results are expected in Q1 2020 and will be incorporated into the PFS due in Q2 2020. Upon successful completion of the PFS study the Company will proceed with an integrated definitive feasibility study (“DFS”) for both the mine/concentrator and lithium hydroxide plant. Primero Group will continue to work on engineering studies related to the spodumene concentrator, and Marshall Miller & Associates will provide ongoing mine planning services. The Company affirms its commitment to complete a DFS for the integrated Piedmont Lithium project by the end of 2020.

Key Quote: “We are very pleased to be working with Hatch on the PFS for our lithium hydroxide project. Hatch has unsurpassed lithium processing experience, having studied directly comparable projects for several clients. Having recently received a landmark permit for our mine/concentrator we are moving full-speed ahead to having a shovel-ready project by the end of 2020.” – Keith Phillips, President & CEO

The Backstory: PLL holds a 100% interest in the Piedmont Lithium Project located within the world-class Carolina TinSpodumene Belt (TSB) and along trend to the Hallman Beam and Kings Mountain mines, historically providing most of the western world’s lithium between the 1950s and the 1980s. The TSB has been described as one of the largest lithium provinces in the world and is located approximately 25 miles west of Charlotte, North Carolina. It is a premier location for development of an integrated lithium business based on its favorable geology, proven metallurgy and easy access to infrastructure, power, R&D centers for lithium and battery storage, major high-tech population centers and downstream lithium processing facilities.

Disclosure

Piedmont Lithium (PLL) is a client of RedChip Companies, Inc. PLL agreed to pay RedChip Companies, Inc. a quarterly cash fee of $20,000, beginning in April 2019, for 12 months of RedChip investor awareness services.

|

|

| |

|

| Nemaura Medical (NASDAQ: NMRD) Expands SugarBEAT® Offering with BEAT® Diabetes Digital Subscription Services |

| |

|

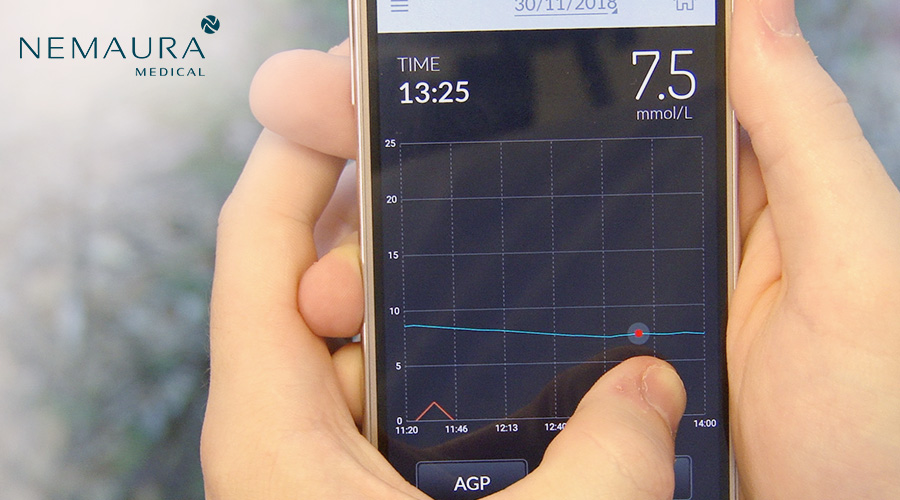

Nemaura Medical (NASDAQ: NMRD), a medical technology company focused on the commercialization of SugarBEAT® as a non-invasive, affordable and flexible Continuous Glucose Monitor (CGM) for diabetics and pre-diabetics, announced that it has expanded its SugarBEAT® CGM capabilities by launching a new digital health offering, BEAT® Diabetes (www.BEATdiabetes.life), which focuses on the prevention and reversal of Type II diabetes through a range of holistic app and coaching services encouraging behavioral change. Both BEAT® Diabetes and SugarBEAT® target the underserved $69 billion market for Type 2 diabetics and $50 billion market for pre-diabetics.

Why It Matters: Combining apps and coaching for patients has been independently and clinically proven to enhance the impact of diabetes management. The full range of services within the BEAT® Diabetes offering, which will be available under a variety of subscription packages, will include an app to track and provide personal lifestyle recommendations to patients according to their blood glucose levels, one-on-one coaching, and routine measurement of other parameters that allow improved disease management through early monitoring. BEAT® Diabetes will track the user’s blood glucose trends and provide information about how their condition is being affected by individual lifestyle factors.

Key Quote: “We believe that simple monitoring of glucose is not enough. Patients need access to a variety of methods to better manage their glucose. The combination of our self-monitoring wearable platform with digital support and prompts, as well as one-on-one coaching through the BEAT® Diabetes app is designed to provide greater optionality and flexibility to both patients and payors alike.” – Dr. Faz Chowdhurry, CEO

The Backstory: SugarBEAT® consists of a daily disposable adhesive skin-patch connected to a rechargeable transmitter, with an app displaying glucose readings every five minutes throughout the day. SugarBEAT® is expected to help a person with diabetes and pre-diabetes better track how lifestyle factors can impact daily glucose level trends (known as an Ambulatory Glucose Profile) thereby significantly improving the amount of daily time spent in range. NMRD received CE Mark approval for SugarBEAT® as a Class IIb medical device in May 2019. Subsequent to the approval, the Company commenced the first phase of the product launch and has gathered feedback from diabetic and non-diabetic users, enabling fine tuning of the user experience.

Disclosure

Nemaura Medical (NMRD) is a client of RedChip Companies. NMRD agreed to pay RedChip a monthly cash fee of $5,000 for six months of investor awareness services. RedChip also received 20,000 shares of Rule 144 stock for services performed between December 2018 and May 2019.

|

|

| |

|

| SinglePoint (OCTQB: SING) Expands Sales for Its 1606 Original Hemp Brand to 8,000 Retailers |

| |

|

SinglePoint (OTCQB: SING) signed an agreement with AFG Distribution of North Carolina to sell, market, and distribute the company’s newest product “1606 Original Hemp” a filtered hemp pre roll. The companies will exhibit at the MJBIZCON show in Las Vegas December 11-13, 2019.

Why It Matters: BDS Analytics and Arcview Market Research projects that the collective market for CBD sales in the U.S. will surpass $20 billion by 2024 while New York-based investment bank Cowen & Co, estimates that the market could pull in $15 billion by 2025. The smokable hemp market currently represents approximately 2% of the overall CBD market, but with a 250% growth from 2017 to 2018, Brightfield Group, a Chicago-based cannabis market research firm, identifies dried and smokable hemp flowers as one of the fastest-growing segments of the CBD market.

Key Quote: “Retail outlets and specialty shops across the country have dedicated shelf space for CBD and are anxious to expand, especially with hemp pre-rolls. SinglePoint as a public company brand brings an elevated standard of product to the market thereby enhancing the consumer’s experience while adding revenues and profits to the retailers.” – Bennett Dickert, AFG Distribution Marketing Manager

The Backstory: SING is a technology and acquisition company with a focus on acquiring companies that will benefit from management, capital and technology integration. The company’s portfolio includes mobile payments, industrial hemp and renewable energy solutions. Through acquisitions into horizontal markets, SING is building its portfolio by acquiring an interest in undervalued companies, thereby providing a rich, diversified holding base.

Disclosure

SinglePoint, Inc. (SING) is a client of RedChip Companies, Inc. SING agreed to pay RedChip Companies, Inc. a $10,000 monthly cash fee, beginning in June 2019, for RedChip investor awareness services and consulting services.

|

|

| |

|

| Catasys (NASDAQ: CATS) Retains President of OPTUM Advanced Data and Analytics at UnitedHealth Group As President & Chief Operating Officer |

| |

|

Catasys (NASDAQ: CATS), a leading AI and technology-enabled healthcare company, today announced the appointment of Mr. Curt Medeiros as President and Chief Operating Officer.

Why It Matters: Medeiros joins Catasys, bringing over 20 years of healthcare and life science experience across various strategic and operational roles. As President at Optum Analytics at UnitedHealth Group, Medeiros focused on creating novel collaboration opportunities that addressed health system challenges between payers, provider systems and Optum’s pharmaceutical, biotech and medical device clients with a goal of applying learnings from real-world data to drive improvements in patient outcomes, total cost of care and satisfaction. In his previous roles at Optum, he led the Optum Life Sciences business, which drives client value by providing best in class real-world data, analytics, consulting and collaborations aimed at improving the health care system for all stakeholders.

Key Quote: “At this innovative time in our history, we are pleased to have Curt join our leadership team as President and Chief Operating Officer. During his nearly 10-year tenure at UnitedHealth Group, one of the largest healthcare companies in the world, Curt demonstrated his ability to design and execute growth strategies, improving all aspects of the business. We believe Curt will be an integral part of our success as Catasys continues on an increasingly accelerated growth trajectory entering 2020, enabling us to help even more people who experience unaddressed behavioral health conditions that worsen chronic medical disease.” – Terren Peizer, Chairman & CEO

The Backstory: CATS is a leading AI and technology-enabled healthcare company whose mission is to help improve the health and save the lives of as many people as possible. Its Catasys PRETM (Predict-Recommend-Engage) platform predicts people whose chronic disease will improve with behavior change, recommends effective care pathways that people are willing to follow, and engages people who aren’t getting the care they need. By combining predictive analytics with human engagement, CATS delivers improved member health and validated outcomes and savings to healthcare payers.

Disclosure

Catasys (CATS) is a client of RedChip Companies, Inc. CATS agreed to pay RedChip Companies, Inc. a $5,000 monthly cash fee, beginning in February 2017, for RedChip investor awareness services and consulting services.

|

|

| |

|

| |

| Quote of the Week |

| |

"Get to know management, look for intelligence, a high level of integrity, strong communication skills and make sure they understand their products and business well."

- Charles Diker, Diker Management |

|

|

|

|

|

|

|

| About RedChip |

| |

| RedChip Companies, an Inc. 5000 company, is an international investor relations, media, and research firm focused on small-cap and mid-cap companies. Since 1992, RedChip has delivered concrete, measurable results for its clients through the most comprehensive service platform in the industry for small-cap and mid-cap companies. These services include a worldwide distribution network for its stock research written by analysts holding the CFA designation; retail and institutional roadshows in major U.S. cities; outbound marketing to stock brokers, RIAs, institutions, and family offices; a digital media investor relations platform that has generated over 2.3 million unique investor views; quarterly global online institutional and retail investor conferences that reach over 10,000 investors annually; "The RedChip Money Report" television show which airs in 100 million homes across the U.S. on The Family Channel; a weekly newsletter delivered to 60,000 investors; TV commercials in local and national markets; corporate and product videos; website design; and traditional investor relation services, which include press release writing, development of investor presentations, quarterly conference call script writing, strategic consulting, capital raising, and more. |

| |

| RedChip Disclosure |

| |

RedChip Companies, Inc. research reports, company profiles and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that the RedChip Companies Inc. is an investor relations firm hired by certain Companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and view RedChip’s Disclosures. |

|

| |

|

|

| |

|

|

Copyright © 2019 RedChip Companies, Inc. All Rights Reserved.

You are receiving this message because this email address has signed up to receive News Alerts.

|

|

|