MoM Generates Significant Increases in Transaction Volume, Net Revenue and Gross Profit

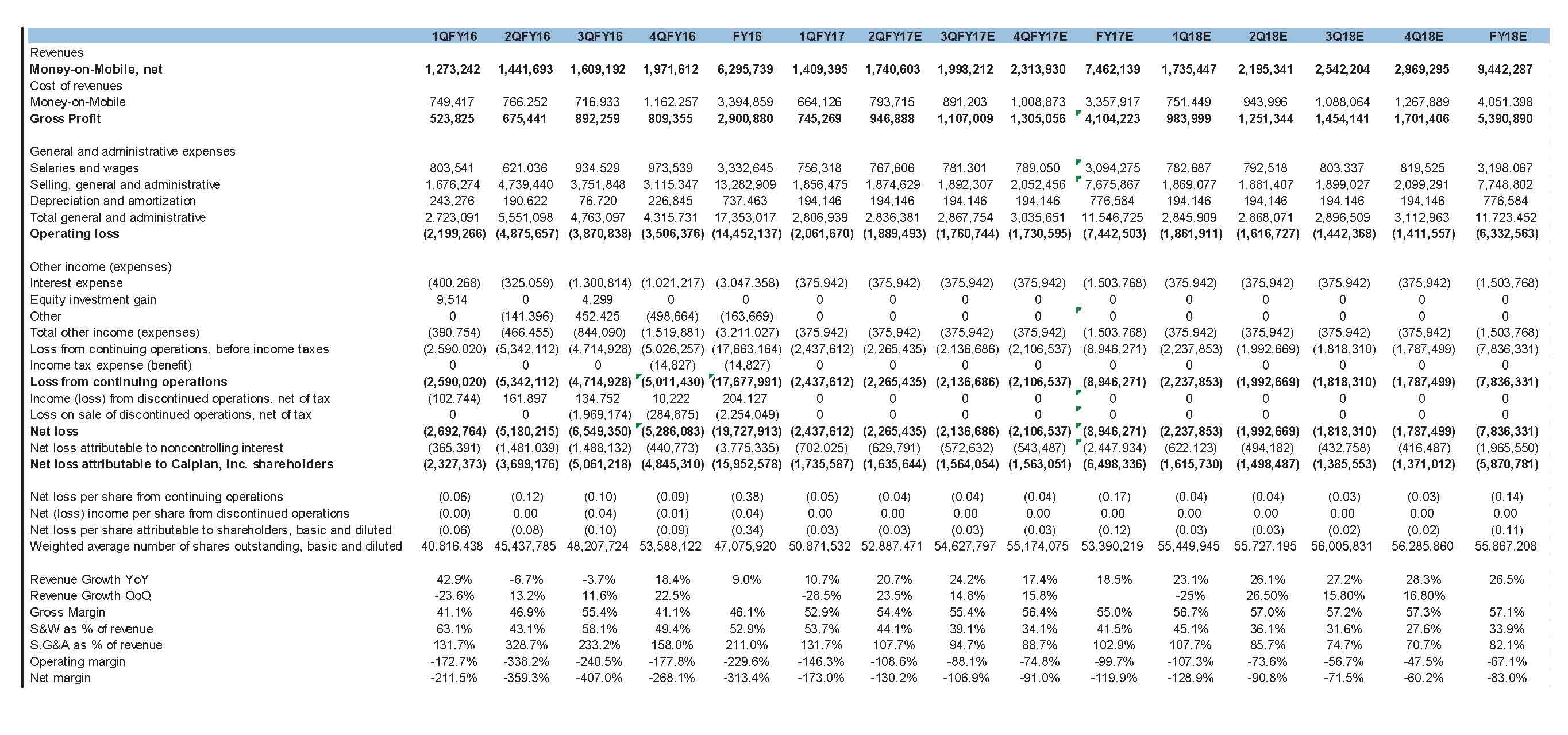

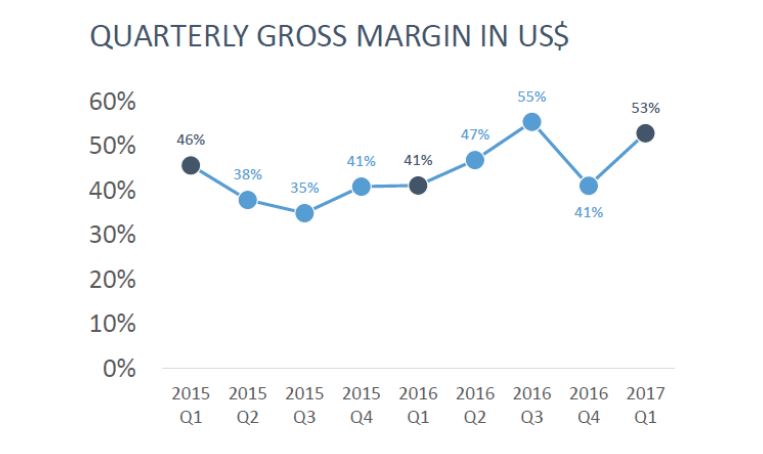

Strong increases in processed volume, net revenue and gross profit in 1QFY17. Money on Mobile (MoM) showed significant increases in processed volume, net revenue, and gross profit in 1QFY17. Processed volume of $224 million represented an increase of 108% YoY. Net revenue of $1.4 million represented an increase of 11% from 1QFY16. Gross profit of $745,269 showed a strong 42% increase from 1QFY16. These increases have primarily been driven by domestic money transfers. The Company charges a fixed fee per transfer, leading to processed volume growing at a significantly faster rate than net revenue. Money transfers are higher margin, thus leading to gross profits growing at a much faster rate than net revenue. MoM’s gross margin was 52.9% in 1QFY17, up from 41.1% in 1QFY16. Increased volume from money transfers should continue to lead to higher gross margins (50%+), in our view. The following chart from MoM shows the elevated gross margins that have occurred in recent quarters:

We believe gross profit is the most important metric for investors to track over the near-term.

MoM’s operating loss and net loss attributable to stockholders in 1QFY17 were ($2.1 million) and ($1.7 million), respectively. MoM is now wholly focused on Indian operations, and we expect the Company to move toward breakeven as a focus on higher margin transactions, such as money transfers, drive improvements in transaction volume and gross profits.

Other metrics indicate increasing usage and reach of MoM. MoM is currently available in 319,292 retail locations in India, up from 316,655 stores in May 2016, representing an increase of 2,637 locations.

There are consistently between 7-8 million users per month using MoM. The Company also continues to offer additional services to gain more users and increase the amount of transactions from these users. These services include free 30-day accident insurance coverage, which is important considering the number of migrant manual laborers in India, and the introduction of eCommerce payments through India’s largest eCommerce website, Flipkart, and Amazon.com. Over time, these services should increase the amount of transaction volume and gross profit earned through its users.

MoM engaged US Capital Partners for a $10 million equity raise. We expect this capital raise to help expand the Company’s footprint through India (by adding additional retail locations/agents) and invest in expanding inventory and improving operations. Our current model does not incorporate an equity raise, but we would expect results to accelerate if additional capital is raised.

MoM’s focus on building trust among individuals in India should build a long-term, sustainable advantage in India’s unbanked population. The majority of MoM’s focus has been on increasing its amount of retail locations, and entering into partnerships that both drive business and provide services that improve the lives of Indian citizens. Trust is a major part of transactions in India, and building trust over time by increasing their agents in India (people in India tend to be more likely to make transactions through individuals they trust) and through services/partnerships such as free 30-day accident insurance coverage and its partnership with the Kalighat Society, will increase trust and make individuals much more likely to use MoM and increase the number of transactions performed through MoM. This should provide a loyal user base; additionally, we believe that increases in transactions per individual would lead to higher long-term operating/net margins.

Larger market opportunity for MoM versus other successful mobile payment solutions. Other successful mobile payment solutions include QIWI in Russia and MPESA in Kenya. QIWI generates annual gross profits of $135.6 million (adjusted for employee compensation and related taxes) and MPESA generates annual net revenue of $410 million. MoM has a much larger potential market size in India, with the Company estimating a potential customer size of 600 million, versus 70 million in Russia and 30 million in Kenya. India is also the world’s fastest growing economy in 2015, with GDP growing 7.5%. Long-term, the India market is likely to provide an overall superior opportunity to either Russia or Kenya. MoM only has a fraction of the potential 600 million unbanked individuals in India, and only a fraction of the potential transaction volume per individual. MoM has the ability to leverage its current market leading position in India among the unbanked and expand in what we consider to be the largest unbanked opportunity in the world. We believe that the success of QIWI and MPESA provides an analog for MoM’s long-term potential, although best-case scenarios for MoM would generate results multiple times higher than what we believe could be achieved by QIWI in Russia or MPESA in Kenya. We expect MoM to achieve profitability as its revenues and volume increase over the next few years. If profitability occurs and revenues/gross profits begin accelerating rapidly, we would also expect market multiples for MoM to increase as well.

Additional Information

Auditor: Liggett, Vogt and Webb, PA

Legal: Sichenzia, Ross, Friedman, Ference, LLP

Transfer Agent: Securities Transfer Corporation

Company Contact Info:

MoneyOnMobile, Inc.

500 N. Akard Street

Dallas, TX 75201

214-758-8600

http://investors.money-on-mobile.com/

Investor Contact Info:

RedChip Companies Inc.

1017 Maitland Center Commons Blvd.

Maitland, FL 32751

(407) 644-4256

www.RedChip.com