Oasmia Pharmaceutical AB

(NASDAQ: OASM, NASDAQ Stockholm: OASM.ST, Frankfurt: OMAX.GR)

RESEARCH REPORT

March 21, 2016

Stock Information

Market Data

| Fiscal Year | April |

| Industry | Biotech |

| Market Cap | $108.7M |

| Price/Earnings (ttm) | N/A |

| Price/Book (mrq) | 2.0x |

| Price/Sales (ttm) | 143.2x |

| Insider Ownership | 52.2% |

| ADS Outstanding | 35.2M |

| Equity Float | 16.8M |

| Avg. Volume (3 mo.) | 7,574 |

Income Statement Snapshot

| Revenue (TTM) | $0.8M |

| Net Loss | ($16.8M) |

Balance Sheet Snapshot

| Cash* (MRQ) | $19.0M |

| Debt (MRQ) | $10.4M |

*Adjusted for $9.6 million in net proceeds from 10/28/15 equity offering.

Company Overview

Oasmia Pharmaceutical AB (“Oasmia,” “OASM,” or the “Company) develops new cancer drugs for use in humans and animals. The Company’s technology is a drug-delivery system that, in comparison with current alternatives, improve care, reduce side-effects, and reduce patient treatment times. OASM’s lead drug Paclical/Apealea is a chemotherapy drug that demonstrates equal efficacy to chemotherapy drugs Taxol and Abraxane while providing a superior risk profile. Paclical/Apealea has completed a successful phase 3 clinical trial. Paclical has been launched in Russia, and is expected to receive European approval in 2H16 and U.S. approval in 2017.

Value Proposition

Based on a NPV analysis, we are valuing OASM at $6.87 per ADS.

Investment Highlights

- XR-17 is a novel technology platform applicable across a wide variety of APIs regardless of therapeutic area

- Successful phase 3 trial completed comparing Paclical, in combination with carboplatin, to Taxol

- Taxol peaked at $1.6 billion in revenue before becoming generic and is approved for a dozen cancer indications

- Pharmacokinetic study shows that Paclical and Abraxane have nearly identical concentration curves of both total and unbound paclitaxel

- Paclical does not require additional chemicals to improve its solvency and is more cost effective than Abraxane

- Paclical is expected to be approved in the EU in 2H16, and in the U.S. in 2017

- OASM received market approval in Russia and CIS in April 2015

- Paclical has completed a study showing it to be bioequivalent to Abraxane; OASM is currently finalizing a study comparing treatment regimens of Paclical vs. Abraxane in metastatic breast cancer

- OASM’s Docecal, which is based on chemotherapy API Docetaxel, has initiated two in-man studies

- Doxophos is based on doxorubicin, the active ingredient in Doxil; Doxil supply shortages create market need and potential near-term revenue in Russia

- Launched Paccal Vet-CA1 in July 2014 for mammary and squamous cell carcinoma; potential near-term revenue

- Doxophos Vet is in a phase 2 trial to treat lymphoma in dogs

- OAS-19 combines two different chemotherapies in a single dose

- $10.4 million in gross proceeds from U.S. share offering provides funds to advance the commercialization of Paclical and other clinical trial programs

- OASM has patent protection until 2028 and onwards

XR-17 is a novel technology platform applicable across a wide variety of APIs regardless of therapeutic area. XR-17 is a novel, broadly applicable technology platform. XR-17 can encapsulate individual APIs along with combining multiple APIs with different solubility profiles. This is evidenced by the five drug candidates (in three different APIs) that the Company is developing to treat cancer in both humans and animals.

OASM’s three candidates make up approximately 80% of the standard of care chemotherapy treatments for the most common cancer types. Additional indications and new drugs built around other APIs are potentially on the horizon.

XR-17 is a nanotechnology platform, based on a Vitamin A derivate, that improves drug solubility without adding toxic solvents. Drugs that are not water soluble cannot be easily delivered through the bloodstream to targeted tissues. Essentially, XR-17 takes APIs that are water-insoluble and makes them water-soluble, without adding additional toxicity. This leads to a number of advantages over competing drugs, including:

- Higher drug doses

- Shorter infusion times

- No pre-medication

- Lower costs, both in drug production and clinic costs

The Company’s formulation may result in improved safety, efficacy, and ease of use as compared to existing drugs. Nanoparticle drug delivery in oncology has been validated, with an example of this in successful chemotherapy drug Abraxane.

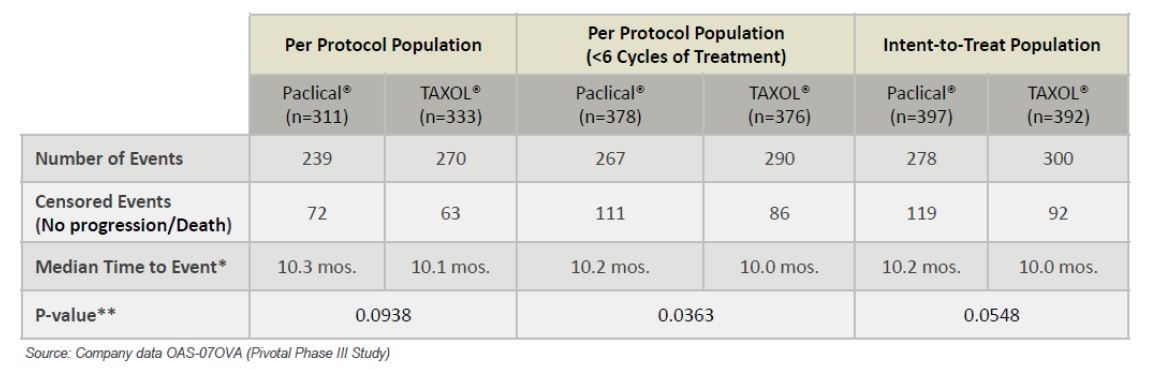

Successful phase 3 trial completed comparing Paclical, in combination with carboplatin, to Taxol. Phase 3 trials have been completed which compared Paclical, in combination with carboplatin, to Taxol in epithelial ovarian cancer. According to the National Cancer Institute, 185,000 women have ovarian cancer in the U.S. It is estimated that 22,280 women will develop ovarian cancer in 2016 and 14,240 women will die from ovarian cancer in 2016 in the U.S. (source: American Cancer Society). Epithelial ovarian cancer is the most aggressive sub-type, and accounts for 85%-90% of all U.S. ovarian cancers. Current therapies offer limited long-term efficacy, and there are high rates of drug resistance. The U.S. market size for ovarian cancer is estimated at $366 million.

The phase 3 trial showed, at a minimum, at least equal efficacy when compared to Taxol, and showed an improved safety and tolerability profile as compared to Taxol. The solvent Cremophor EL is used to deliver Taxol. However, the toxicity of Cremophor EL limits the dose of Taxol that can be delivered.

As the following charts indicate, Paclical shows a longer progression free survival (PFS) as compared to patients receiving Taxol (as defined by the median time to event):

Additionally, patients with more frequent CT (every 3rd month during follow-up), showed even more improvement in the median PFS, with Paclical having a median PFS of 12.0 months, as compared to 10.2 months for Taxol (p=0.0357). The same pattern was seen when using the CA 125 test for measurement, with Paclical having a median PFS of 9.1 months, as compared to 8.7 months of Taxol (p=0.1324).

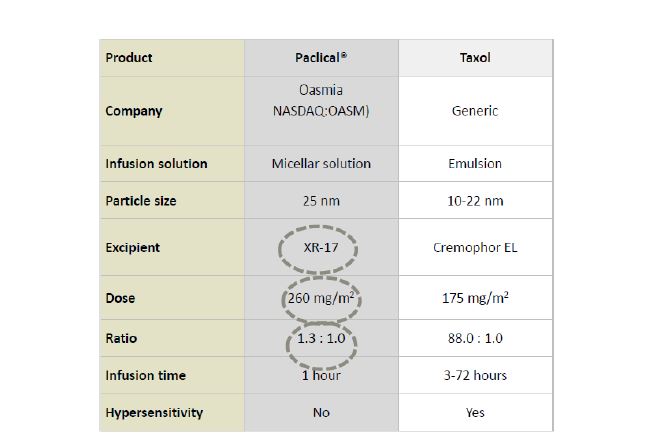

Safety profiles between Paclical and Taxol (aside from minor differences in neutropenia and peripheral sensory neuropathy) are similar. Paclical’s risk/benefit profile is superior due to the fact that it does not require pre-medication; Paclical also gives patients a higher dose of paclitaxel (250mg/m2 of Paclical vs. 175 mg/m2 of Taxol):

Hypersensitivity reactions were the same for patients with Paclical without pre-medication as compared to Taxol with pre-medication. Pre-medication (steroids and antihistamines) is required to reduce the toxicity of the Taxol/Cremophor EL combination. This is critical, as hypersensitivity reactions to chemotherapy represent a serious complication. Overall, Paclical met its primary endpoint of progression-free survival, while showing a positive risk/benefit profile as compared to Taxol.

Taxol peaked at $1.6 billion in revenue before becoming generic, and is approved for a dozen cancer indications. Paclical has a number of advantages over Taxol, including a shorter infusion time (1 hour for Paclical vs. 3-72 hours for Taxol), a higher dose (250 mg/m2 of Paclical vs. 175 mg/m2 of Taxol), and no need for premedication to reduce the incidence of hypersensitivity. Taxol is currently approved for a dozen cancer indications; we believe that Paclical has the potential to be approved for many of these same cancer indications, giving the drug the potential to build a platform across a broad range of cancers.

Taxol peaked at $1.6 billion in annual sales before becoming generic. Taxol and Abraxane (paclitaxel is the API in both) currently generate $1.7 billion in combined annual sales.

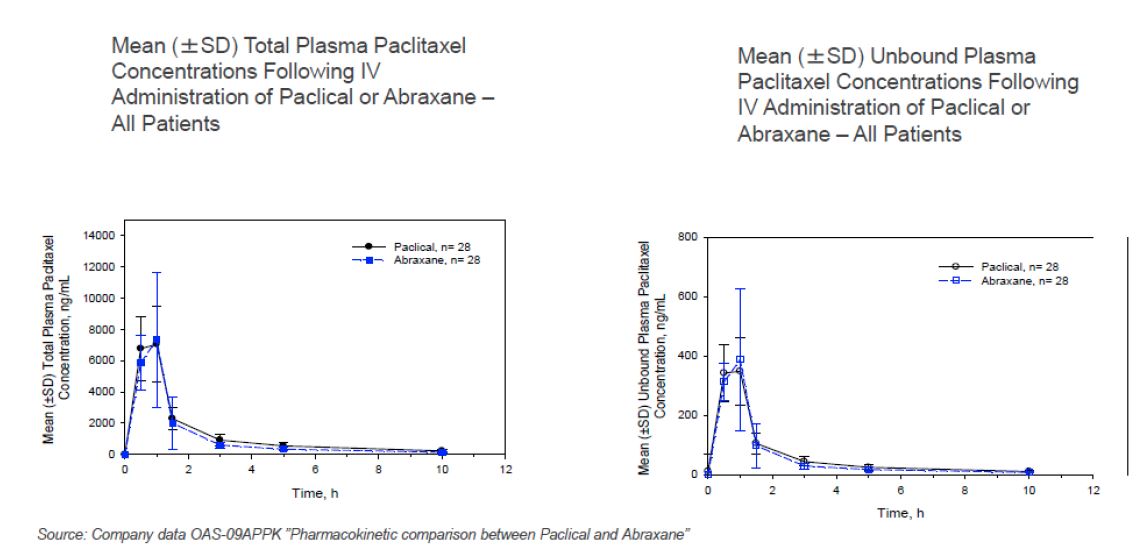

Pharmacokinetic study shows that Paclical and Abraxane have nearly identical concentration curves of both total and unbound paclitaxel. Abraxane is currently the highest grossing paclitaxel drug on the market. Analysts are projecting Abraxane’s revenue at approximately $1.1 billion in 2016 and over $1.3 billion in 2017. Abraxane received approval for metastatic breast cancer in 2005 and added lung cancer in 2012 and pancreatic cancer in 2013. A recent pharmacokinetic study, which used intravenous infusion of 260 mg/m2 for both drugs, showed that Paclical and Abraxane have nearly identical concentration curves of both total and unbound paclitaxel. Unbound paclitaxel is what gives the drug its effect in the clinic. The study was in 28 women with metastatic breast cancer. The nearly identical concentration curves are indicated by the nearly identical overlap in the charts below:

The nearly identical concentration curves imply that the efficacy of the two drugs are equal. There were no serious adverse events; 11 grade 3 adverse events were reported for Paclical and 10 grade 3 adverse events were reported for Abraxane.

Paclical does not require additional chemicals to improve its solvency and is more cost effective than Abraxane. Abraxane is paciltaxel suspended in human albumin. Paclical does not contain human albumin. Paclical is projected to be more cost effective than Abraxane. Paclical is expected to sell for approximately $1,000 per vial in the U.S. and $300 per vial in Europe. The margins in Europe are estimated to be 15%, and will likely be higher in the U.S. This could be crucial for gaining market share, particularly when considering skyrocketing health costs.

Paclical is expected to be approved in the EU in 2H16, and in the U.S. in 2017. We expect the Company to commence commercialization efforts shortly after approval. OASM has submitted a Market Authorisation Application in Europe. OASM has rebranded Paclical in Europe with the name Apealea.

Paclical will be approved through the 505(b)(2) regulatory pathway in the U.S. The 505(b)(2) pathway allows for an NDA in which some of the information for the NDA is not provided by the applicant. OASM has also received an orphan designation in the U.S. and EU for epithelial ovarian cancer. Due to this, OASM will have seven years of market exclusivity within the U.S. and ten years of market exclusivity within Europe.

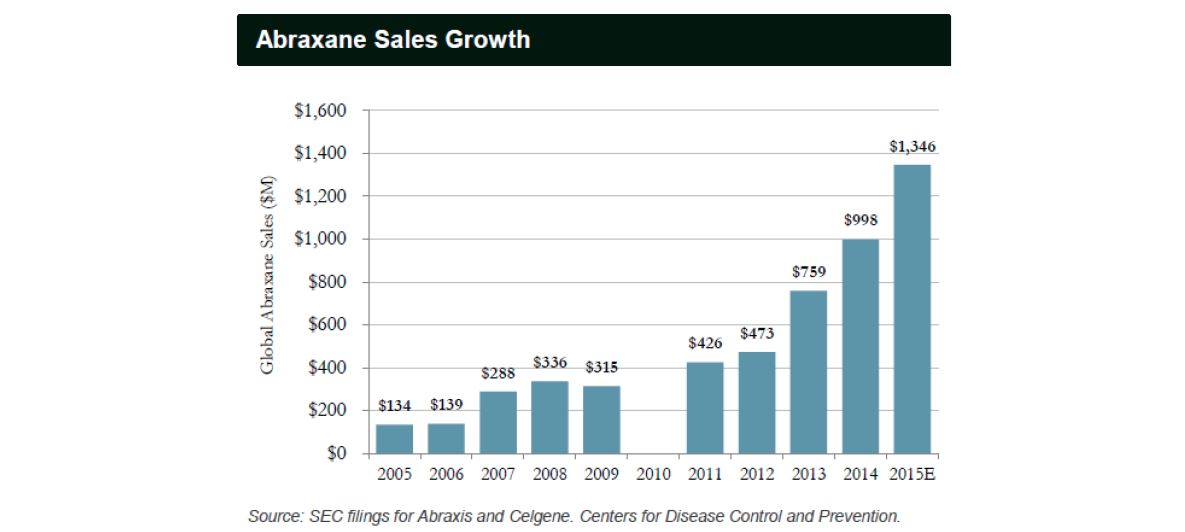

OASM is following patients in the phase 3 trial to measure overall survival, and results from this are expected in 1H16. This data is expected to provide the information needed for full global approval of Paclical. Abraxis, the original inventor/producer of Abraxane, shows a successful commercialization roadmap that can be used by a smaller biotech company like Oasmia. The following chart shows the increase in sales from Abraxane since its approval in 2005. Additional approvals for lung cancer in 2012 and pancreatic cancer in 2013 greatly increased the revenue received from Abraxane:

OASM will use a direct commercialization strategy similar to that employed by Abraxis to market Abraxane in 2005. OASM also anticipates a direct commercialization strategy in some areas in the EU.

OASM owns the global rights to Paclical, excluding Israel, Turkey, Russia, the CIS, Ukraine, Georgia, and Turkmenistan. This gives OASM the ability, if it chooses, to obtain full revenue and profits from the world’s largest drug markets.

OASM received market approval in Russia and CIS in April 2015. Paclical will be marketed by Pharmasyntez in Russia. So far, the end user sales value for orders in Russia have totaled $9 million. These orders happened within the first week of approval. The chemotherapy market in Russia totals over $2 billion annually, and is growing at 36% per year. Additionally, cancer death rates in Russia are higher than in other developed countries, with Russian citizens having a cancer death rate of 60%, as compared to 40% in the United Kingdom and 33% in the United States. This demonstrates the significant need for improved chemotherapy treatment in Russia.

Paclical has completed a study showing it to be bioequivalent to Abraxane; OASM is currently finalizing a study comparing treatment regimens of Paclical vs. Abraxane in metastatic breast cancer. Breast cancer is one of the world’s most prevalent and deadly cancers. The World Health Organization (WHO) estimates that 1.38 million women are diagnosed with breast cancer each year, and 458,000 women die from the disease annually. OASM has completed a phase I, dose-finding study of weekly administration in metastatic breast cancer patients.

Abraxane was originally approved for use in metastatic breast cancer. As stated above, Paclical was shown to be bioequivalent in metastatic breast cancer patients. In 2011 (the last year metastatic breast cancer was Abraxane’s sole indication), Abraxane generated $426 million in sales. This indicates the potential for strong sales if Paclical is approved for metastatic breast cancer.

OASM’s Docecal, which is based on chemotherapy API Docetaxel, has initiated two in-man studies. OASM is expected to commence a First Patient in Study for Docecal in 1Q16. Following this, OASM is expected to begin a Phase I pharmacokinetic study comparing Docecal to Taxotere in 2Q16. Docetaxel is the most active ingredient in chemotherapy treatment Taxotere, which is marketed by Sanofi-Aventis. Taxotere (now generic) earned $2.8 billion in revenue for Sanofi-Aventis in 2010 (representing its final year before patent expiration). Taxotere is used to treat prostate cancer, breast cancer, lung cancer, gastric cancer, and head & neck cancer.

Advantages of Docecal as compared to Taxotere include that it is solvent free, requires no pre medication to prevent hypersensitivity, and has a much better carrier to API ratio (Docecal - 2.25:1.00 vs. Taxotere – 26.00:1.00). This gives Docecal advantages over Taxotere. We believe that Docecal, relative to Taxotere, will have less hypersensitivity, better uptake, shortened infusion times, and better long-term efficacy, due to the ability to give higher doses of Docetaxel in Doecal. In vitro studies across six different cancer cell lines showed that Docecal is as effective as Taxotere in inhibiting cell growth.

Much like with Paclical, Docecal has the potential to gain approval in the cancers that Taxotere is used for (breast, prostate, lung, gastric, and head & neck cancer). This gives Docecal broad long-term potential. OASM has worldwide rights for Docecal.

Doxophos is based on doxorubicin, the active ingredient in Doxil; Doxil supply shortages create market need and potential near-term revenue in Russia. Doxorubicin is the API in Adriamycin, Caelyx, and Doxil. Doxil had sales of $600 million in 2013. Doxorubicin has treated leukemia, Hodgkin’s lymphoma, bladder cancer, stomach cancer, lung cancer, ovarian cancer, and thyroid cancer.

A global shortage of Doxil was created due to the closing of a plant which was Johnson and Johnson’s only supplier of Doxil. Supply shortages for Doxil have existed since 2011, generating a strong need for new chemotherapies based on the API doxorubicin. This need led to the Company applying for market approval for Doxophos in Russia, and the Company expects approval by the end of 2016. Market approval would earn the Company revenue from Doxophos in the short-term while Doxophos undergoes clinical trials for U.S. and EU approval.

In other markets, the Company is currently preparing to commence a phase I clinical trial in Doxophos for breast cancer. Prior to commencing this trial, OASM is waiting to evaluate safety data from using Doxophos in a study in dogs. To date, no safety problems in dogs have been observed. We believe that Doxophos could have utility in other cancers that are presently treated by Doxorubicin.

Launched Paccal Vet-CA1 in July 2014 for mammary and squamous cell carcinoma; potential near-term revenue. Paccal Vet would be the first chemotherapy treatment for dogs on the market. Chemotherapy treatment currently available for dogs are off-label uses of chemotherapy intended for human use. OASM received conditional approval in the U.S. for Paccal Vet on February 7, 2014, for mammary carcinoma and squamous cell carcinoma in dogs. These conditions were granted the Minor Use and Minor Species designation in the U.S. This is similar to receiving an orphan drug designation in humans. OASM believes that Paccal Vet can be on the market for five years, and extended through annual renewals, until Paccal Vet generates the required data for full FDA approval. There is potential for near-term sales from Paccal Vet.

OASM also plans to introduce a lower dose Paccal Vet that can be used to potentially access a wider market of veterinarians. This lower dosage would be expected to carry less severe side effects, and thus could be used across a wider variety of indications.

A phase 3 trial for Paccal Vet was initiated in 4Q14. The trial includes 165 dogs with mammary carcinoma and 165 dogs with squamous-cell carcinoma. Successful results from this trial would likely lead to full approval.

Previous studies in mammary cell carcinoma and squamous-cell carcinoma have shown an effect for Paccal Vet. Overall, 10 dogs have been treated for mammary cell carcinoma, and six dogs showed a response to treatment. In 18 dogs with squamous-cell carcinoma, six dogs showed the best overall response rate (BORR) and two dogs had a prolonged stable disease.

50% of mammary carcinoma tumors are malignant, and this typically leads to death once the cancer has metastasized. Early detection of squamous cell carcinoma is critical, and fewer than 20% metastasize.

The Company estimates that the total market for Paccal Vet-CA1 in the U.S., EU, and Japan is 900,000 dogs per year. If 100,000 dogs were treated in year five (price of $3,500-$4,000, market penetration of about 11.1%) this would lead to annual sales of approximately $350-$400 million.

There are approximately 80 million dogs in the U.S., and 25% of these dogs will die of cancer. More dog owners have been treating their dogs with medications. According to the American Pet Products Association, 78% of U.S. dog owners treated their dogs with medications in 2010, as compared to 50% of U.S. dog owners in 1998. These figures provide justification for the potential of Paccal Vet-CA1 to possibly obtain 11% market share by year five.

Oasmia is launching its own platform and sales network to market Paccal Vet-CA1. Paccal Vet has been licensed for sale in Japan, Russia, and the CIS. Paccal Vet-CA1 was previously marketed/distributed by Zoetis, a global veterinary drug company.

Potential competition for Paccal Vet and Doxophos Vet include Palladia, made by Zoetis, Inc., Masivet, made by AB Science S.A., and AT-004 and AT-005, made by Aratana Therapeutics, Inc. Off-label human chemotherapy drugs could provide additional competition. Masivet, or Kinavet as it is named in the US was withdrawn from the market in Dec 2015 due to awaiting for additional clinical results.

The Company is also running a study involving at least 50 dogs with mast cell tumors. The results of this study are expected to provide the basis for a clinical trial in Europe. Mast cell tumors are common malignant tumors in dogs.

Doxophos Vet is in a phase 2 trial to treat lymphoma in dogs. Lymphoma is one of the most common cancers in dogs and occurs about 2 to 5 times more frequently in dogs then in people. Given this, the market opportunity for lymphoma in dogs could be significant. Doxophos Vet is currently in a phase 2 trial for lymphoma.

OAS-19 combines two different chemotherapies in a single dose. Combination therapies have become more common in cancer. Chemotherapies are combined by taking into account different mechanisms of action and different toxicity profiles. By combining two different chemotherapies, a more complete kill of cancer cells occurs. Dosing two chemotherapies in a single infusion could decrease infusion times, the number of visits to the clinic, and lower overall treatment costs. OAS-19 is currently in preclinical studies. OASM owns the global rights to OAS-19.

$10.4 million in gross proceeds from U.S. share offering provides funds to advance the commercialization of Paclical and other clinical trial programs. Proceeds from the capital raise are allocated for the following:

- $4.3 million to fund new clinical trials and fulfill other regulatory requirements ($1.5 million for animal, $2.5 million for human, $0.3 million for XR-17 pharmcokinetic)

- $1.0 million for Paccal Vet phase 3 trial for mammary carcinoma and squamous cell carcinoma – this is estimated to get the trial to 15%-20% completion

- $0.5 million for Doxophos Vet to continue a phase 2 study to assess the response rate in treated dogs for lymphoma – this is estimated to get the trial to 60% completion

- $1.5 million for phase 1 study for Docecal in breast cancer – this is estimated to get the trial to 50% completion

- $0.2 million for phase 1 study for Doxophos in breast cancer – this is estimated to get the trial to 15% completion

- $0.3 million for phase 1 study for Paclical in breast cancer – this is estimated to get the trial to under 10% completion

- $2.0 million to fund production development, including validation batches

- $1.0 million for general corporate purposes

We estimate the Company’s monthly burn rate at $1.4 million, although this could vary depending on trial requirements and sales in Russia.

OASM has patent protection until 2028. OASM owns 91 patents and has 22 patents pending worldwide.

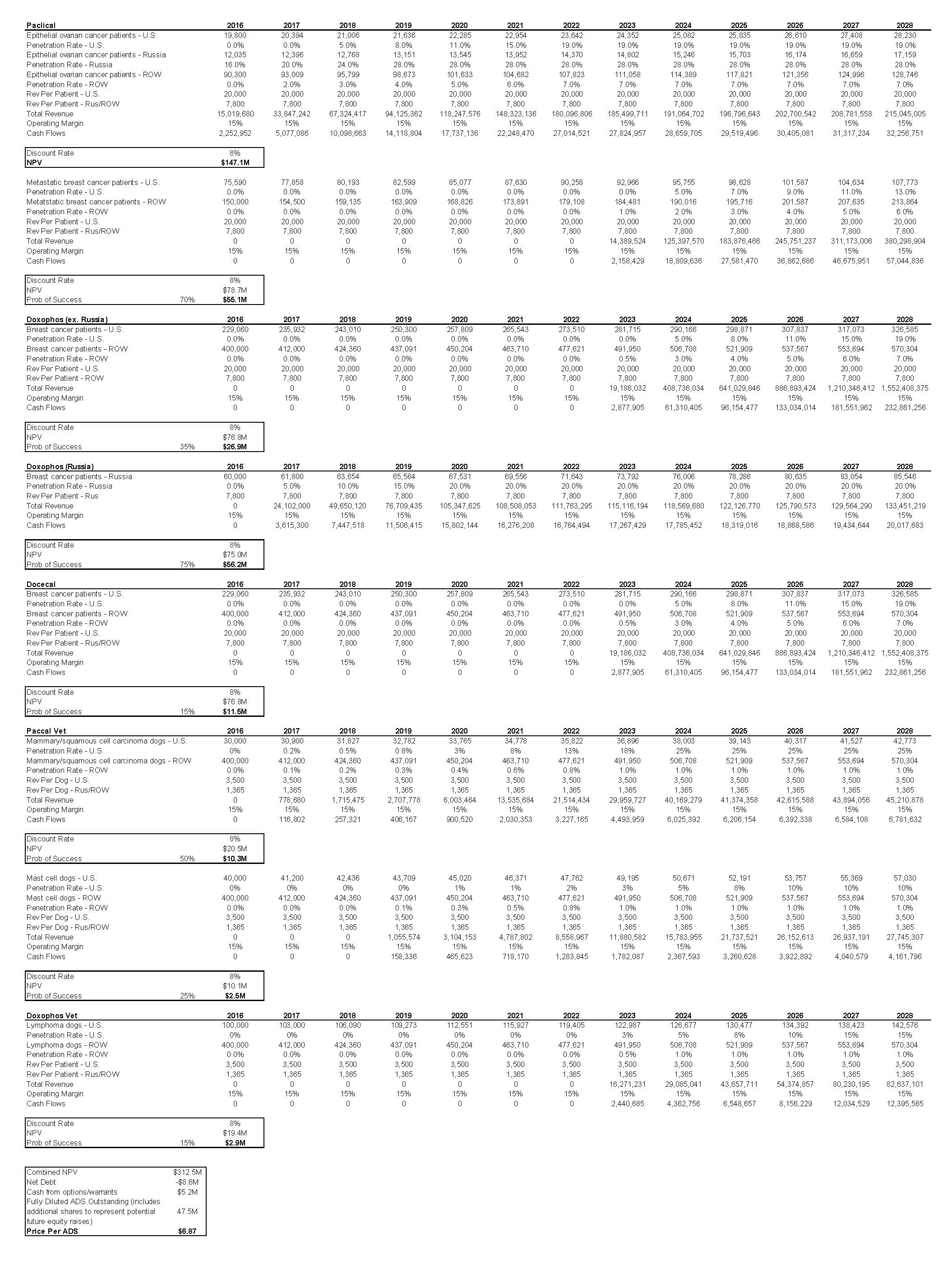

Valuation

Based on a NPV analysis, we are valuing OASM at $6.87 per ADS. Combined, all of the Company’s therapies that are currently in clinical trials are based on APIs that make up approximately 80% of chemotherapy usage. These chemotherapies generate significant sums of annual revenue across a variety of different types of cancers. We believe that the Company’s therapies (Paclical, Docecal, and Doxophos) could eventually gain approval for some of these indications. This gives the Company’s XR-17 technology long-term platform potential. Some other points in our model:

- The majority of our value comes from Paclical, as this is already generating revenue in Russia and has projected near-term approval in the U.S. and EU.

- We expect strong near-term sales in Russia from both Paclical and Doxophos. This should generate strong cash flow for the Company which can then be used on other clinical programs and/or to market its drugs in the larger U.S. and European markets.

- We are projecting 15% operating margins on sales. We expect the Company to directly sell the majority of their therapies (outside of select worldwide licensing agreements).

- As the Company’s drugs are based on currently marketed APIs, the clinical trial timeline should be shorter versus the majority of other biotech companies.

- Our model currently accounts for therapies in which the Company is currently participating in human clinical trials. Further platform expansion is not taken into account, which provides further long-term upside. This expansion could be in a number of areas, including using drugs such as Paclical in different types of cancer, the development of its dual encapsulation technology, OAS-19, or in APIs that are different from the chemotherapy APIs the Company is currently developing.

- We believe that platform potential is significant, given the large amount of indications the underlying APIs currently treat.

Risks

There is no guarantee that Paclical will be approved in the U.S. or EU for ovarian cancer. There is no guarantee that the Company will achieve approval in the U.S. or EU for ovarian cancer. However, the Company has completed a successful phase 3 trial in Paclical, and approval appears very likely.

OASM’s future capital needs are uncertain. OASM has a number of ongoing programs, including programs built around three different APIs, clinical trial programs in both human and animal indications, and a promising preclinical technology which combines two different chemotherapies together. Additionally, the Company has begun making sales in Russia, and is likely to soon commence sales efforts in the U.S. and EU. Future mid-term capital needs will be determined by how many/which programs the Company enters into, and sales from Paclical and Paccal Vet.

There is no guarantee that the Company’s drugs will displace entrenched chemotherapies. Other chemotherapies, such as Abraxane and Taxol, have already generated huge amounts of sales, and many doctors are using these drugs. However, Paclical has a number of advantages over these therapies, including cost, infusion times, and no pre-medication.

The Company may not be able to effectively build a direct sales force. OASM is building a direct sales force to sell Paclical, and eventually other drugs, in the U.S. and EU. There is no guarantee this strategy will be successful. However, Abraxis used this strategy with Abraxane and it was successful.

Additional Information

Auditor: Ernst & Young AB

Legal: Setterwalls Advokatbyrå AB & Sichenzia Ross Friedman Ference LLP

About RedChip

RedChip Companies, an Inc. 5000 company, is an international small-cap research, investor relations, and media company headquartered in Orlando, Florida; with affiliate offices in New York, Pittsburgh, and Seoul. RedChip delivers concrete, measurable results for its clients through its extensive global network of small-cap institutional and retail investors. RedChip has developed the most comprehensive platform of products and services for small-cap companies, including: RedChip Research(TM), Traditional Investor Relations, Digital Investor Relations, Institutional and Retail Conferences, "The RedChip Money Report"(TM) television show, Shareholder Intelligence, Social Media and Blogging Services, and Webcasts. RedChip is not a FINRA member or registered broker/dealer.

RedChip Companies, Inc. research reports, company profiles and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law, RedChip Companies, Inc., our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information).

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov.

Oasmia Pharmaceuticals (OASM) is a client of RedChip Companies, Inc. OASM agreed to pay RedChip Companies, Inc. a monthly cash fee for 12 months of RedChip investor awareness services.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.

Additional information about the subject security or RedChip Companies Inc. is available upon request. To learn more about RedChip’s products and services, visit www.redchip.com, call 1-800-RedChip (733-2447), or email info@redchip.com.

Company Contact Info:

Oasmia Pharmaceutical AB

Vallongatan 1

SE-752 28 Uppsala

Sweden

Tel: +46 18 50 54 40

info@oasmia.com

Investor Contact Info:

RedChip Companies, Inc.

1017 Maitland Center Commons Blvd.

Maitland, FL 32751

(407) 644-4256

www.redchip.com