CGIX Received $7.1 million in New Contract Bookings for Biopharma Services in 2Q17

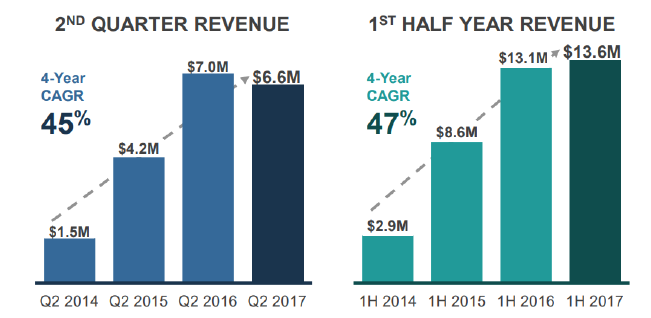

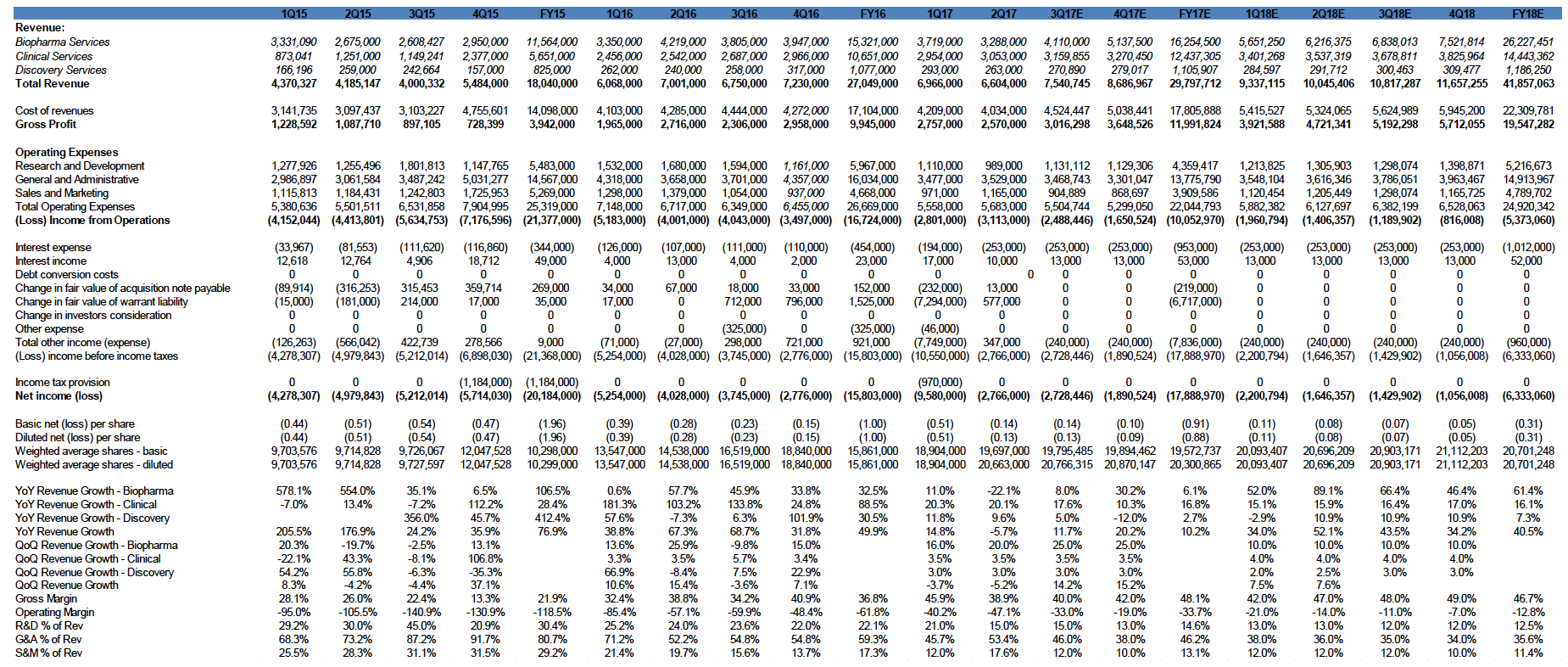

The company received record biopharma demand in 2Q17 with $7.1 million in new contract bookings for biopharma services. Total revenue declined to $6.6 million in 2Q17, down 5.7% from $7.0 million in 2Q16. Test volumes increased 6% YoY to 14,341. Revenue from clinical services increased to $3.0 million in 2Q17, up 20% from 2Q16. The total decline in YoY revenue was due to delays from multiple larger customer clinical trials. We expect strong improvement in gross margins in 2017 as test volumes increase and expect it to reach high 50% to low 60% range once the Company reaches approximately $10 million in quarterly revenue

Net loss in 2Q17 was $2.8 million or ($0.51) per diluted share, an improvement of 43% compared to a net loss of $4.0 million in 2Q16. This was achieved with growing test volumes and improvement in operating efficiencies.

Completed Accretive Acquisition of vivoPharm, a Global Oncology & Immuno-Oncology Discovery Services company that generated $5.0 million of annual revenue in 2016 and a 14% CAGR over the past three years. Completed Accretive Acquisition of vivoPharm, a Global Oncology & Immuno-Oncology Discovery Services company that generated $5.0 million of annual revenue in 2016 and a 14% CAGR over the past three years.

vivoPharm expands CGIX’s market penetration into Europe and Asia-Pacific. vivoPharm serves over 40 biotechnology and pharmaceutical companies across five continents and over 80% of its customers are based outside the U.S., expanding CGIX’s geographical footprint across Asia-Pacific and Europe. vivoPharm has powered 30+ immuno-oncology studies and trials, and has supported 200 INDs across 20+ indications. This enables CGIX to expand its discovery and early development revenue with highly complementary biotechnology and pharmaceutical customers in Europe and Asia-Pacific. Also, it transforms the value proposition of the company by increasing drug identification, drug rescue and drug repurposing capabilities.

Based in Australia, vivoPharm provides CGIX with numerous advantages. The Australian government offers attractive R&D tax incentives including cash rebates. According to a cost comparison study, Australia is 28% cheaper than U.S before tax incentives; and 60% cheaper after-tax incentives. Also, the Australian clinical trials process allows flexibility and faster speed in conducting clinical trials without compromising the quality; with an added advantage of these clinical trials being acceptable by the US Food and Drug Administration (FDA).

CGIX launches two new offerings: FDA-approved universal companion diagnostic for lung cancer and NGS liquid biopsy test. CGIX is one of the first laboratories (one of the only three) in the United States to offer ThermoFisher’s Oncomine DX Target Test, the first next generation sequencing (NGS) based companion diagnostic test that simultaneously screens tumor samples for biomarkers associated with three FDA-approved therapies for non-small cell lung cancer (NSCLC). This test simultaneously evaluates 23 genes clinically associated with NSCLC, and results from analysis of three of these genes can be used to identify patients who may be eligible for treatment with drugs such as gefitinib (AstraZeneca), crizotinib (Pfizer), trametinib (Novartis) and dabrafenib (Novartis). With this test, physicians can now match patients to these therapies in days instead of weeks.

The Company also launched its NGS liquid biopsy test for lung cancer patients in May 2017. The liquid biopsy market is expected to reach $1.6 billion by 2021, up from $0.58 billion in 2016, growing at a CAGR of 23.4% (MarketsAndMarkets). CGIX’s NGS-based liquid biopsy test for lung cancer provides comprehensive coverage of 11 critical genes and 150+ hotspots related to lung cancer. The test has numerous advantages in comparison to tissue biopsy. Primarily, the test is significantly less costly and less invasive when compared to tissue biopsy.

Lung cancer is the leading cause of cancer death among both men and women in the United States; 1 out 4 deaths are from lung cancer and NSCLC accounts for 85% of all lung cancers. We believe with the introduction of these two tests, the Company has broadened its reach with various customers in the oncology market and has significant potential to increase its revenue run rate in subsequent quarters while providing the Company a step-up in its oncology testing profile

Operating expense reduction moving CGIX toward profitability. CGIX continues to lower operating expenses. We have been impressed by the Company’s ability to grow revenue while reducing expenses. Operating expenses fell to $5.7 million in 2Q17, down from $6.7 million in 2Q16.

The reduction in operating expenses was driven by greater operating efficiencies and the successful integration of Response Genetics, headcount reduction, reorganization of technology, and benefits from shared services with CGI’s India team. Margin improvements should play a large role in moving the Company toward profitability.

Continuing to build test portfolio, infrastructure, and intellectual property/knowledge; we believe that this backbone will translate into near-term revenue opportunities in biopharma and set up longer-term opportunities in clinical services. CGIX has continued to build its intellectual property and test portfolio, with 16 genomic tests commercially launched, 18 collaborations with leading institutions, and 90 patents globally. Recent highlights include the launch of an NGS panel for Hereditary Breast & Ovarian Cancer; CLIA validation for FOCUS::Renal™; New York state approval for FOCUS::Myeloid™; a partnership with ApoCell that leverages their proprietary, high-performance liquid biopsy platform for rare cell capture and detection; and a collaboration with BARC Global Central Laboratory to offer comprehensive clinical trial and companion diagnostic solutions for oncology clients.

Further R&D should lead to the launch of additional tests and improvements to current test offerings. This should lead to near-term growth in biopharma revenue and longer-term in clinical services.

Strategic agreements with Mendel AI and Lantern Pharma to jointly leverage genomics, biomarkers & artificial intelligence (AI) to rescue and repurpose drugs for cancer. CGIX’s partnerships with Mendel AI and Lantern Pharma provides the company with vast amounts of data, that combined with artificial intelligence (machine learning algorithms) will play a significant role in delivering information regarding enrolling trial sites, patient history and disease staggering information. A McKinsey & Company report recently concluded that the big data revolution is in its early days in the biopharma industry and the potential value creation is still unclaimed. According to the report, big data strategies could generate up to $100 billion in value across the US healthcare system. Big data provides biopharma companies essential data points that can be effectively used to identify new potential drug candidates, improving efficiency of research and clinical trials.

Current expected future revenue from biopharma contracts is more than $40 million; forecasted to increase as the number of trials and trial complexity both increase. CGIX’s current expected revenue from biopharma contracts is more than $40 million (this revenue is expected to be realized between 2017-2018). CGIX continues to aggressively expand its biopharma services. The Company saw a 53% increase in the number of biopharma projects over the past 12 months, reaching 170 clinical trials in 2Q17, up from 111 in 2Q16. The Company also generated a significant increase in its immuno-oncology projects over the past 12 months to 39 in 2Q17, up from 15 in 1Q16. The immuno-oncology market is expected to reach over $35 billion by 2024 (source: IMS Health) and impact up to 60%-70% of cancer patients. The accretive acquisition of vivoPharm, which management believes will bring immediate revenue and income to the company, also adds 30 new immuno-oncology projects in early phase trials that may lead to phase two and phase three trials which will position CGIX to be focused on a near-term drug rescue.

Given the expected significant growth in immuno-oncology over the next decade, providing services for immuno-oncology clinical trials should drive consistent revenue growth for CGIX’s biopharma services, along with providing significant long-term revenue potential in clinical services. As more immunotherapies are approved for use in the clinic, we anticipate clinical demand for multi-gene NGS panels to increase. CGIX’s current focus on biopharma services should generate a positive impact both for current results with longer-term potential in clinical services and companion diagnostics.

We derived a target price of $7.34 by applying a 5.0x EV/S to our FY17E revenue of $29.7 million. We are projecting further improvements to net loss in FY2017, as Biopharma services revenue increases and the effects of operational improvements and expense reductions are realized. Our model assumes modest quarter-on-quarter growth through 2018, although our assumptions could change if we see meaningful volume increases in some of the Company’s proprietary tests. We believe that FHACT and the Tissue of Origin test are the most likely candidates to show volume increases over the near-term. CGIX has built a significant backbone of intellectual property and proprietary genomic tests. This expertise has enabled the Company to consistently grow its Biopharma services business, which we believe will eventually lead to significant growth in clinical services revenue. The Company’s rapid increase in immuno-oncology trials is very promising, as many top analysts expect immuno-oncology to have a huge impact on future cancer treatment. Our estimates do not yet include the recent acquisition of vivoPharm.

In particular, we believe that a strong economic case will be given for the use of NGS testing alongside immunotherapies, especially given NGS’s high cost (typically $100k+) and the increasing evidence of the need for variable treatment regimens dependent on specific patient characteristics. CGIX’s strong, disease-focused knowledge base should prove valuable as immunotherapies and targeted therapies are approved for indications where the Company has developed expertise. Any companion diagnostic approvals should greatly increase clinical services revenue. Ultimately, we believe that the clinical services opportunity is a matter of “when”, not “if.” Given this backdrop, we believe the company is on a solid track to reach profitability. Strong improvements in operating expenses and margins were achieved in 2016 and 2Q17. We are not currently modeling any additional capital raises, although a small capital raise could be needed depending on how long it takes CGIX to further reduce costs. Controlling costs ensures that the Company minimizes dilution while the clinical opportunity develops.

View Full Image

Additional Information

Legal: Lowenstein Sandler LLP

Auditor: McGladrey LLP

Transfer Agent: Continental Stock Transfer & Trust Co.

Comany Website

About Redchip

RedChip Companies, an Inc. 5000 company, is an international small-cap research, investor relations, and media company headquartered in Orlando, Florida; with affiliate offices in San Francisco, Pittsburgh, and Seoul. RedChip delivers concrete, measurable results for its clients through its extensive global network of small-cap institutional and retail investors. RedChip has developed the most comprehensive platform of products and services for small-cap companies, including: RedChip Research(TM), Traditional Investor Relations, Digital Investor Relations, Institutional and Retail Conferences, "The RedChip Money Report"(TM) television show, Shareholder Intelligence, Social Media and Blogging Services, and Webcasts. RedChip is not a FINRA member or registered broker/dealer.

RedChip Companies, Inc. research reports, company profiles and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law, RedChip Companies, Inc., our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information).

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov.

Cancer Genetics, Inc. (CGIX) is a client of RedChip Companies, Inc. CGIX has agreed to pay RedChip a monthly cash fee for twelve (12) months of RedChip investor awareness services.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.

Company Contact Info

Cancer Genetic, Inc

201 Route 17 North 2nd Floor

Rutherford, NJ 07070.

(201)528-9200

www.cancergenetics.com

Investor Contact Info

RedChip Companies, Inc

107 Maitland Center Commons Blvd.

Maitland, FL 32751

(407)644-4256

www.RedChip.com

Additional Information

Auditor: MaloneBailey LLP Legal Counsel: LucoskyBrookman Transfer Agent: Computershare