Company Overview

Interpace Diagnostics (NASDAQ: IDXG) develops and commercializes molecular diagnostic tests to detect genetic and other molecular alterations that are associated with gastrointestinal and endocrine cancers. The Company generates revenue from the clinical use of the Company’s proprietary molecular diagnostic tests, which leverage the latest technology in personalized medicine for better patient diagnosis and management. IDXG’s three molecular tests currently on the market are covered for approximately 250 million Americans by Medicare and leading regional health plans.

Valuation

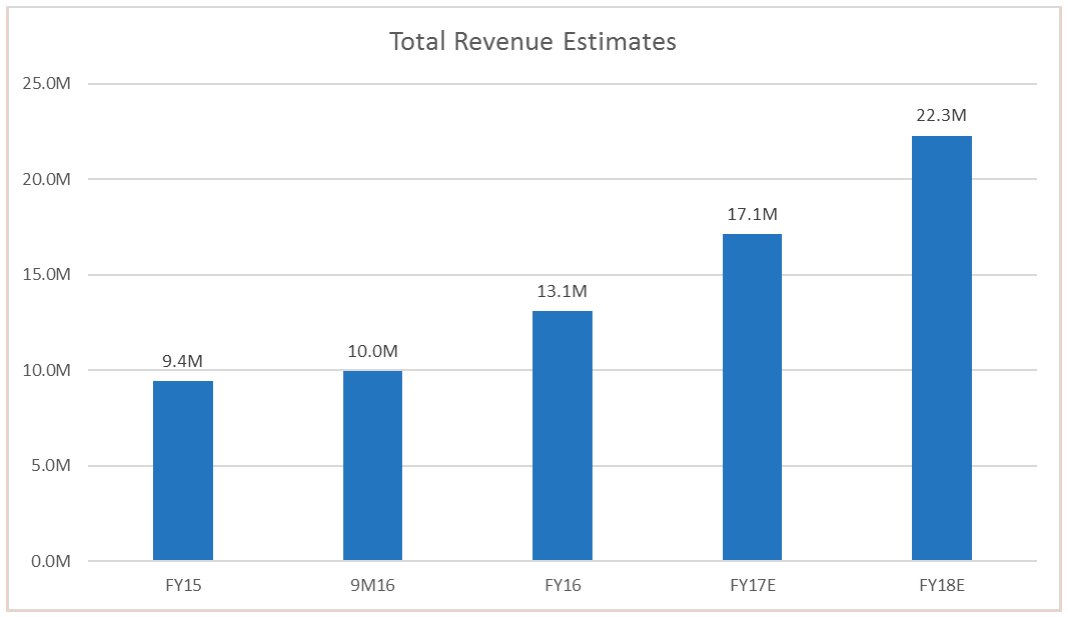

We are valuing IDXG using a 3.0 EV/S multiple applied to our FY18 sales estimate of $22.3 million. This gives us a near-term target price of 6.00 per share.

Investment Highlights

- IDXG reported revenue of $13.1 million in FY16, an increase of 39% YoY

- Revenue of $3.1 million for 4Q16, an increase of 22% YoY

- IDXG develops cutting-edge molecular diagnostic tests for pancreatic, Thyroid and Esophageal cancer

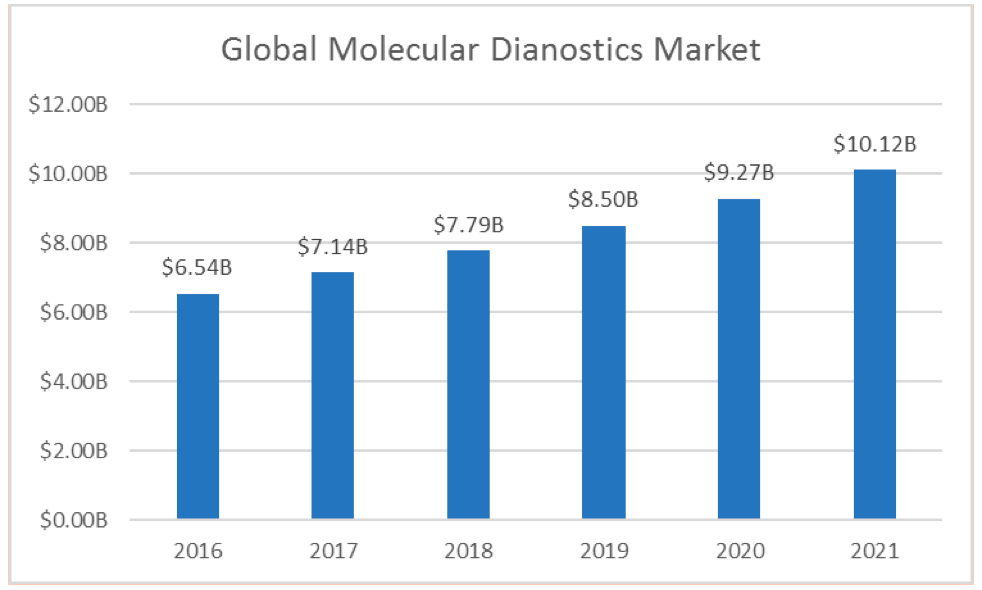

- Molecular diagnostic market to reach $10.1 billion by 2020

- Current combined market opportunity for Pancreatic and Thyroid cancer is$700 million in the United States.

- IDXG’s PancraGen testing provides an alternative option to surgery assessments for malignancy in pancreatic cysts

- Tests examine indeterminate cyst’s potential for uncontrolled cell growth and progression to malignancy

- IDXG’s ThyGenX and ThyraMIR combined biomarker and DNA testing for thyroid cancer helps to better assess the risk of thyroid nodules

- Clinical evidence supports combined testing:

- 85% reduction in unnecessary surgeries

- 94% likelihood negative results are truly benign

- 74% likelihood positive results are malignant

- IDXG’s molecular diagnostic tests are covered for approximately 250 million Americans by Medicare and leading regional health plans

- Multibillion dollar M&A activity is taking place in molecular diagnostics

- The global molecular diagnostic market is expected to reach $10.1 billion by 2021

IDXG reported revenue of $13.1 million in FY16, an increase of 39% YoY. Gross profit for the period was $6.4 million, or 49% of net revenue. The increase in revenue and gross profits is attributed to the increase in sales and the reduction in operating expense. The company also benefitted from restructuring obligations related to the sale of its CSO business in 2015.

Since December 2016, the Company has raised $14 million in gross equity and restructured over $9.3 million of secured debt by converting to equity to further strengthen its balance sheet. Management intends to use the new capital for working capital, repayment of debt, and general corporate purposes.

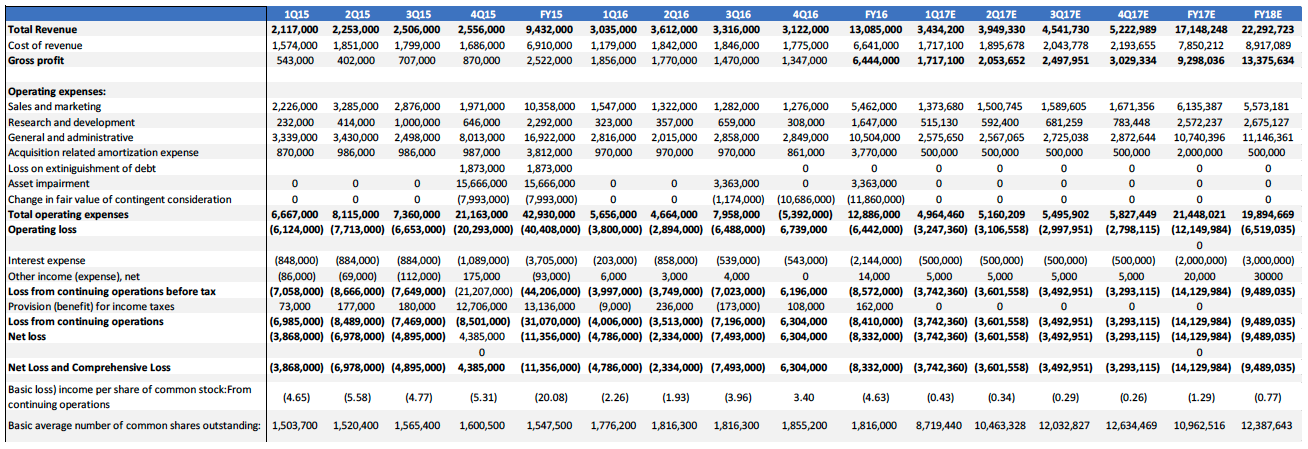

Figure 1:Revenue Estimates

IDXG develops cutting-edge molecular diagnostic tests for pancreatic, Thyroid and Esophageal cancer

The company’s tests are primarily focused on early detection of cancer and leverage the latest technology to improve patient diagnosis, leading to a reduction in unnecessary surgeries. IDXG currently has three commercialized molecular tests and one in development:

- PancraGEN Test : A pancreatic cyst molecular test

- ThyGenX Test : Assesses thyroid nodules for risk of malignancy

- ThyraMIR Test : Assesses thyroid nodules for risk of malignancy utilizing proprietary gene expression assay

- Barrett's Esophagus Test(BarreGEN) : Esophageal cancer risk classifier (Development Stage)

There are 49,000 new pancreatic cancer cases detected each year, and it’s the fourth leading cancer killer in the U.S., according to the American Cancer Association. New cases of thyroid cancer are even higher, at 56,870, with about 2,010 related deaths.

Molecular diagnostics (MDx) allows for patients to receive faster and more accurate diagnosis. MDx is a new class of diagnostic tests that identify acids or proteins to test the status of a disease. MDx is the fastest growing segment within the in-vitro diagnostic space. The market for MDX is projected to reach $10.12 billion by 2021, according to MarketsAndMarkets. While competition in the molecular diagnostic industry continues to increase, IDXG’s tests are first of their kind in their respective oncology field Some of the leading factors to the growth in the pancreatic and thyroid diagnostic market are:

- Increasing healthcare costs

- New technological advances

- Growing concern across the world

Figure 2:Global Molecular Diagnostic Market Estimate

Current pancreatic and thyroid cancer diagnostics are based on patient’s clinical history and cyst images that include MRI and CT scan diagnosis, typically known as first line assessments. IDXG’s molecular diagnostic tests include mutational analysis that helps risk stratify for thyroid and pancreatic cancers to evaluate treatment options. In addition, IDXG’s unique DNA based diagnosis for pancreatic and thyroid cancer provides oncologists in-depth evaluation on cancer cell.

IDXG’s PancraGEN test provides an alternative option to surgery assessments for malignancy in pancreatic cysts. PancraGEN is a unique DNA-based molecular pathology test that that uses a small sample of pancreatic cyst fluid to assess the risk of cancer in patients progressing in patients who have indeterminate biopsies.

Recent technological advancements in molecular pathology have increased the number of patients that are diagnosed in initial stages of pancreatic cysts, but less than 1% will be malignant. Current testing methods are based on cyst’s image using MRI and CT scans. Although these procedures provide some information and properties of the cyst, they fail to provide the necessary insight to properly stratify a patient’s cancer risk.

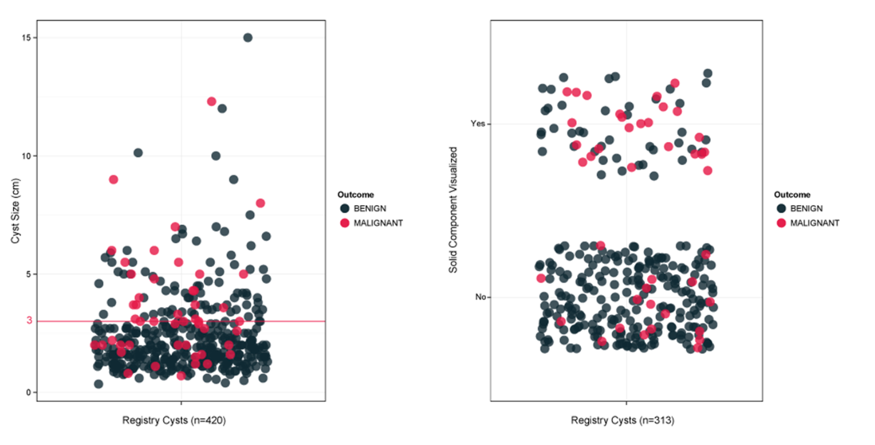

Figure 3: Current Test Reports

The above figure displays some of the results from current diagnostic procedures. Cyst that are small (<3cm) can be malignant and cysts that are large (>3cm) can be benign. Likewise, most cysts with a solid component are benign and cysts lacking a solid component can be malignant.

The PancraGEN diagnostic approach provides information on the quality and quantity in cyst fluid. The report provides information on the high levels of intact DNA that are associated with actively dividing cells. It provides information of oncogene (potential cancer causing gene) mutations and provides information on tumor suppressor gene mutations. A snapshot of the PancraGEN report is shown below:

This report provides doctors and physicians the information they need to make more informed decisions by categorizing cysts into four groups that will determine the nature of the progression of cancer or tumor. The cyst can be benign, statistically indolent, statistically higher risk, and aggressive. Identifying the specific status of the cancer can lead to better diagnosis and treatment options and may lead to avoiding unnecessary surgeries.

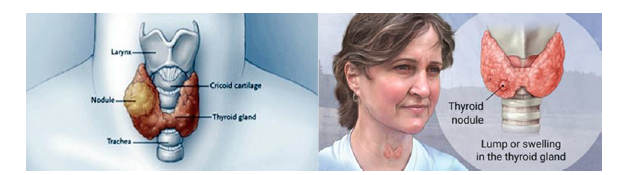

IDXG’s ThyGenX and ThyraMIR combined biomarker and micro RNA testing for thyroid cancer helps to better assess the risk of thyroid nodules. This testing combination helps to better assess the risk of thyroid nodules being either benign or malignant. The results from the combined testing also provide an estimated accuracy of “Rule in” or “Rule out” for the risk of progression of indeterminate cysts to malignancy. Clinical evidence supports combined testing:

- 85% reduction in unnecessary surgeries

- 94% likelihood negative results are truly benign

- 74% likelihood positive results are malignant

Also, the 74% likelihood of a positive result being malignant is a clinically significant improvement over the 50/50 likelihood of Afirma’s test results.

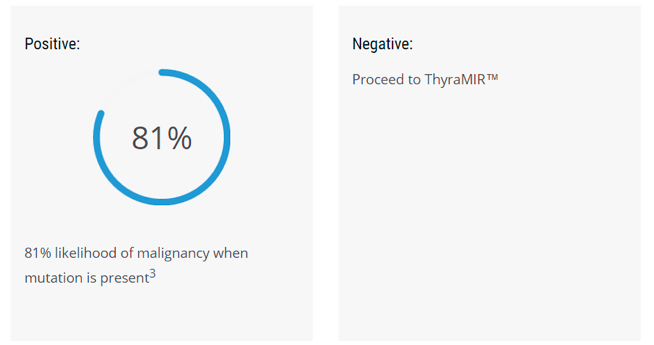

Figure 4: Thyroid Nodule - IDXG uses ThyGenX and ThyraMIR in combination to dectect malignancy in thyroid nodules

According to statistics, 85% to 95% of thyroid nodules are benign. However, thyroid cancer ranks the ninth most common cancer in the United States and according to the American Thyroid Association, approximately 15% to 30% of the 525,000 thyroid fine needle aspirations (FNAs) performed on an annual basis in the U.S. are indeterminate for malignancy based on standard cytopathology. This provides a huge market opportunity for ThyGenX and ThyraMIR. IDXG’s unique combination of ThyGenX and ThyraMIR testing yields high predictive value in determining the presence and absence of thyroid cancer, and improves the risk stratification and surgical decision making when standard cytopathology does not provide a clear diagnosis for the presence of cancer.

ThyGenX testing utilizes state-of-art next generation sequencing(NGS) to identify more than 100 genetic alterations associated with papillary and follicular thyroid carcinomas; the two most common forms of thyroid cancer.

Figure 5: ThyGenX Sample Report

ThyraMIR is a follow up test procedure that can identify malignancy in nodules that are negative for ThyGenX, thereby improving overall sensitivity and ability to detect malignancy. ThyraMIR is the first microRNA gene expression classifier. MicroRNAs are small, non-coding RNAs that bind to messenger RNA and regulate expression of genes involved in human cancers, including every subtype of thyroid cancer. ThyraMIR measures the expression of 10 microRNAs.

Figure 6: ThyraMIR Sample Report

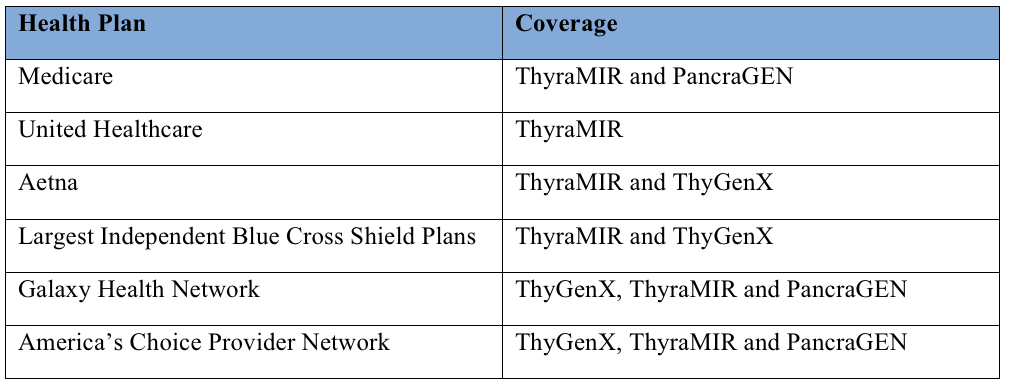

IDXG’s thyroid molecular diagnostic tests are covered for approximately 250 million Americans by Medicare and leading regional health plans. IDXG’s PancraGEN, ThyGenX and ThyraMIR tests are accessible to more than 50 million Medicare patients nationwide. In addition, IDXG’s ThyraMIR is now covered by United Healthcare and Aetna, two of the largest health plans in the U.S., providing coverage to its millions of members nationwide. The table below provides information on IDXG’s diagnostic tests currently covered by health plans in the United States.

Table 1: IDXG’s diagnostic tests currently covered by health plans in the United States

The company also entered into an agreement with Blue Cross Blue Shield Association’s Center for Clinical Effectiveness "Evidence Street", a program that, while not making coverage decisions, provides the Company with the opportunity to provide available evidence for its molecular Thyroid and Pancreas tests to support further coverage determinations among Blue Cross Blue Shield plans and other health plans. We believe that coverage with leading health plans across the country should increase average revenue per test and gross margins

Multibillion dollar M&A activity is taking place in molecular diagnostics. Similar companies operating in IDXG space are being bought at high multiples. Big pharmaceutical companies have demonstrated a high level of interest in acquiring molecular diagnostic companies such as IDXG. With three different diagnostic tests in the healthcare market and one in development stage, Interpace Diagnostic’s cutting-edge molecular diagnostic testing portfolio has the potential to provide personalized patient care in the multibillion oncology testing market (pancreatic, thyroid and Esophageal cancer).

Table 2: M&A in molecular diagnostic Industry

The global molecular diagnostic market is expected to reach $10.1 billion by 2021. According to MarketsAndMarkets, the molecular diagnostic market is expected to reach $10.1 billion by 2021, up from an estimated $6.5 billion in 2016, with growth being driven by biomarker identification and advancements in molecular diagnostic techniques. In addition, the report also concluded that the growing and increasing awareness of personalized medicine, and reimbursement system in the United States are some of the additional factors influencing the growth in the molecular diagnostic market.

IDXG’s three commercialized molecular tests that uses next-generation sequencing and biomarkers in its molecular diagnostic testing provides doctors and physicians the information they need to make more informed decisions, and thus increasing the ability to provide a more personalized oncology care. With the global molecular diagnostic industry growing at 9.0% CAGR, IDXG is well-positioned for growth in the industry.

The molecular diagnostic industry is dominated by major industry players such as Roche Diagnostics (U.S.), Lab Corp(U.S.), QIAGEN N.V. (Netherlands), Abbott Laboratories (U.S.), Hologic Inc. (U.S.), and Grifols (Germany). We believe that the interest for larger companies operating in the molecular diagnostic market indicates the potential revenue available for IDXG in this market. Additionally, IDXG has already announced a collaboration with Lab Corp and has demonstrated the ability to work with a major industry player.

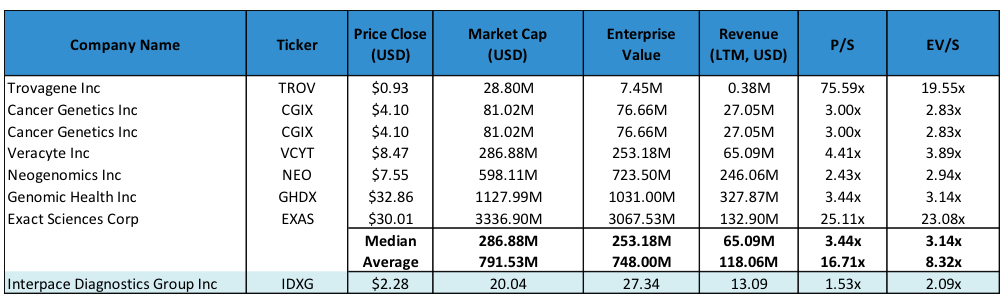

Valuation Conclusion

IDXG’s proprietary cancer tests should continue to grow and improve over time. The molecular diagnostic tests that IDXG currently has out on the market have been proven through clinical testing to be superior to the current standard of testing. The molecular diagnostic testing market is projected to increase substantially over the next few years, and IDXG is poised to take advantage of the growth both through the development of new therapies using biomarkers and hospitals and doctors attempting to make more accurate decisions while saving time and lowering costs.

In addition, the strong M&A activity in the molecular diagnostic industry should elevate multiples across the market, and this should persist as big pharmaceutical and biotech companies look to acquire molecular diagnostic companies, given the growing importance of biomarkers in both treating cancer and developing new and improved therapies. Also, IDXG’s molecular diagnostic tests are covered by Medicare and leading healthcare plans. This ensures that the company’s products are available to millions of Americans and should accelerate the growth in sales and increase margins going forward.

We are valuing IDXG using a 3.0x EV/S multiple applied to our FY18 sales estimate of $22.3 million. This gives us a near-term target price of $6.00 per share. A 3.0x EV/S multiple values IDXG below the low-end of its peer group. We believe a discount is appropriate given that IDXG is a smaller company relative to its peers.

Figure 7: IDXG Peer Comparison

Some notes on our model:

- We are projecting IDXG to earn revenues of $17.1 million in FY17, and 22.3 million inFY18.

- We believe that our FY18 revenue estimate is conservative. IDXG has a robust pipeline ofproprietary cancer tests that should continue to grow and improve over time.

- Our model incorporates equity raises through FY18 to finance operations.

Risks

There are other molecular diagnostic tests in the molecular diagnostic market. Some of these companies may be better capitalized than IDXG and thus could spend more capital on improving diagnostic tests and sales and marketing.

Company’s molecular diagnostic business has limited revenue. IDXG may incur net losses in the foreseeable future and may never achieve or sustain profitability.

There are substantial doubts about IDXG’s ability to continue to run its business operations. Due to the Company’s operating history of net losses, negative working capital and insufficient cash flows, and lack of liquidity to pay its current obligations.

Management Team

Jack Stover, President and CEO

Mr. Stover has been Chief Executive Officer of Interpace Diagnostics since December 2015. From 2005 until 2015 Mr. Stover had been a Director and Chairman of the Audit Committee of PDI, Inc., a public company and the predecessor to Interpace. From April 2014 Mr. Stover was President of. A private company, Zebec Therapeutics LLC (“Zebec”) and its predecessor Quadrant Pharmaceuticals LLC, which Mr. Stover co-founded and was a Director of from September 2013.. From 2009 to February 2012, Mr. Stover served as the executive chairman of Targeted Nano Therapeutics LLC, a privately held biotechnology company focused on targeted delivery of peptides and proteins. Mr. Stover was also chairman of the audit committee and a member of the board of directors of Arbios Systems Inc. from 2005 to 2008 and a member of the board of directors of Influmedix, Inc. from 2010 to 2011.

From 2004 to 2008, he served as chief executive officer, president and director of Antares Pharma, Inc., a publicly held specialty pharmaceutical company listed on the American Stock Exchange. Prior to that, Mr. Stover was executive vice president and chief financial officer of Sicor, Inc., a publicly held company which manufactured and marketed injectable pharmaceutical products, and which was acquired by Teva Pharmaceutical Industries. Prior to that, Mr. Stover was executive vice president and director of a proprietary women’s pharmaceutical company, Gynetics, Inc. (“Gynetics”), and before Gynetics, he was senior vice president and director of B. Braun Medical, Inc., a private global medical device and pharmaceutical company. For more than five years prior to that, Mr. Stover was a partner with PricewaterhouseCoopers (then Coopers and Lybrand), working in the lifesciences industry division. Mr. Stover received his B.A. in Accounting from Lehigh University and is a Certified Public Accountant.

Greg Richard, SVP Commercial Services Greg Richard, Sr. Vice President of PDI, Inc. and SVP of Commercial Services at Interpace Diagnostics, has been in the healthcare business for over 25 years in various industries including managed care, biotech pharmaceuticals, CRO services, and diagnostics. He started his career in sales at Aetna and moved to Genentech as the Director of Managed Care. He transitioned in to the diagnostics industry as the Vice President of Managed Care for Quest Diagnostics and served in this role for 8 years. Greg also led the international clinical trials sales team while at Quest. Following his tenure at Quest, Greg worked for several privately held companies including CRO’s, molecular diagnostics, and anatomic pathology services providers. He also served as the Sr. Vice President of Sales for the Northeast Division of LabCorp. Greg is a certified Six Sigma Green Belt and frequent speaker at healthcare industry conferences such as the G2 Lab Institute and the NextGen Dx Summit.

Syd Finkelstein, Chief Scientific Officer

Dr. Finkelstein is a board-certified pathologist specializing in gastrointestinal pathology with extensive experience in molecular diagnostics. He is the Adjunct Professor of Pathology, Drexel University on the faculty of Allegheny General Hospital, Pittsburgh, PA. He is the founder of RedPath Integrated Pathology, which was acquired by Interpace Diagnostics in 2014

Sara A. Jackson, VP of Clinical Development

Dr. Jackson has 15 years of experience in biomedical research and development. She has been an integral part of both the research and development and medical affairs teams for a variety of pharmaceutical and diagnostics companies, translating biomedical research into viable commercial products. Under Dr. Jackson’s leadership, the clinical development team has conducted various clinical validity and utility studies to support the use of PathFinderTG assays in clinical practice. Their efforts continue to bring new assays to market. Dr. Jackson earned a PhD in biochemistry and molecular genetics from the University of Pittsburgh School of Medicine and completed her postdoctoral research fellowship with the Centers for Disease Control and Prevention. She has co-authored numerous publications and presented at various national and international scientific conferences.

Glenn Gershon, SVP of Operations

Glenn has nearly 30 years of biotechnology industry experience. He has worked for a wide range of companies in roles of increasing responsibility. These roles have included leadership and functional expertise in Quality Assurance, Regulatory Affairs, Customer Service, R&D, Product Development, and Laboratory Operations.

Christina M. Narick, MD, VP of Pathology

As the Vice President of Pathology for Interpace Diagnostics, Dr. Narick provides interpretation and diagnosis of both cytology and molecular cases in Interpace Diagnostics’ state-of-the-art, CLIA-certified, and CAP-accredited laboratory. Dr. Narick is a board-certified anatomic and clinical pathologist and completed her fellowship in cytopathology at Allegheny General Hospital under the direction of Dr. Jan Silverman, a leading authority in cytopathology. Dr. Narick earned her medical and undergraduate degrees from West Virginia University and an MBA from Portland State University. Prior to entering the medical field, Dr. Narick worked in process engineering, quality systems, and operations management in the manufacturing arena.

Figure 8: Income Statement