Chanticleer Holdings, Inc.

(Nasdaq: HOTR)

RESEARCH REPORT

April 12, 2016

Stock Information

Market Data

| Fiscal Year | December |

| Industry | Restaurant |

| Market Cap | $16.64M |

| Price/Earnings (ttm) | 0.92x |

| Price/Book (mrq)* | 0.76x |

| Price/Sales (ttm) | 0.39x |

| Insider Ownership | 3.6% |

| Shares Outstanding | 21.5M |

| Equity Float | 17.8M |

| Avg. Volume (3 mo.) | 67,226 |

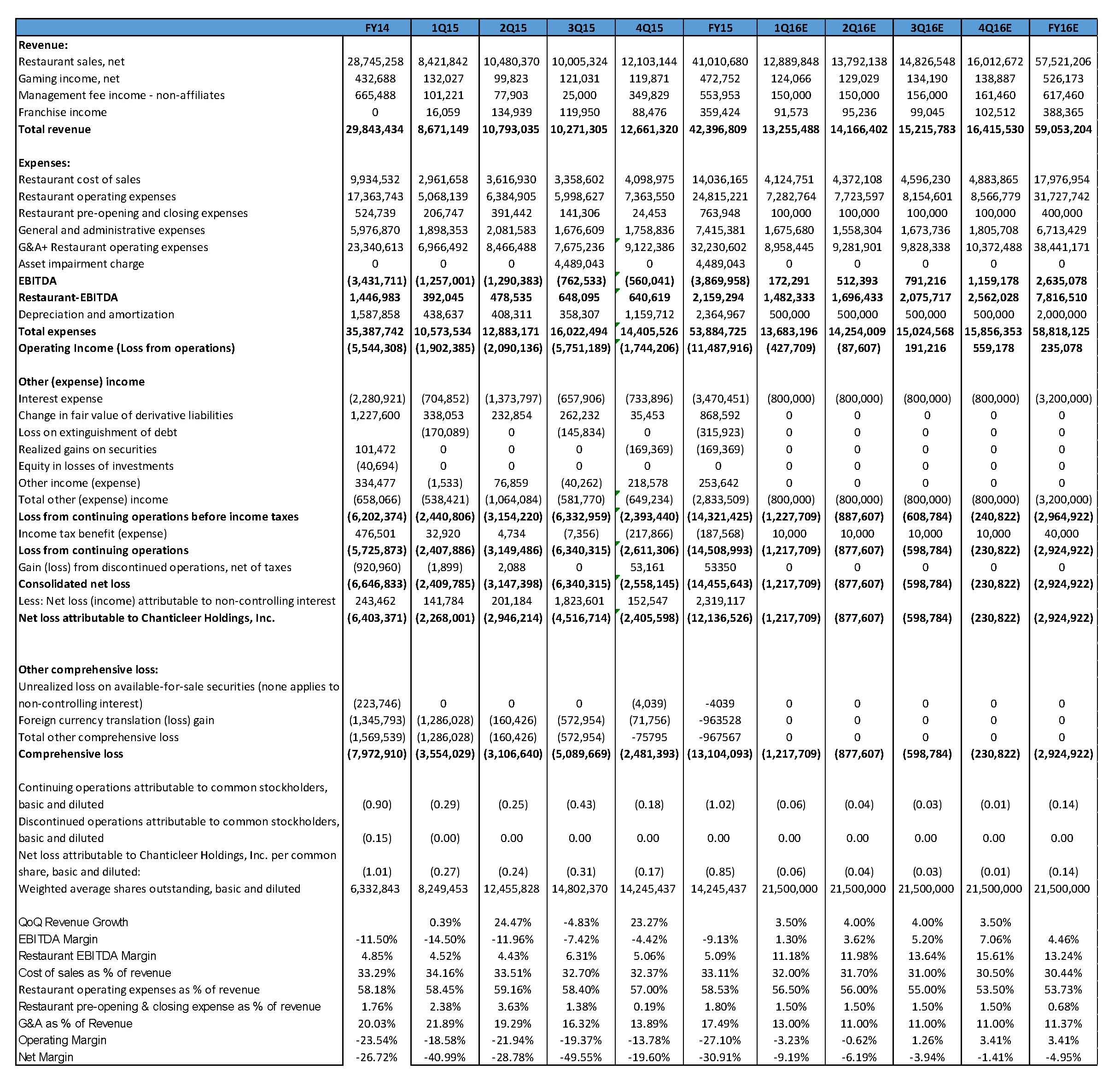

Income Statement Snapshot

| Revenue (TTM) | $42.4M |

| Restaurant EBITDA | $2.1M |

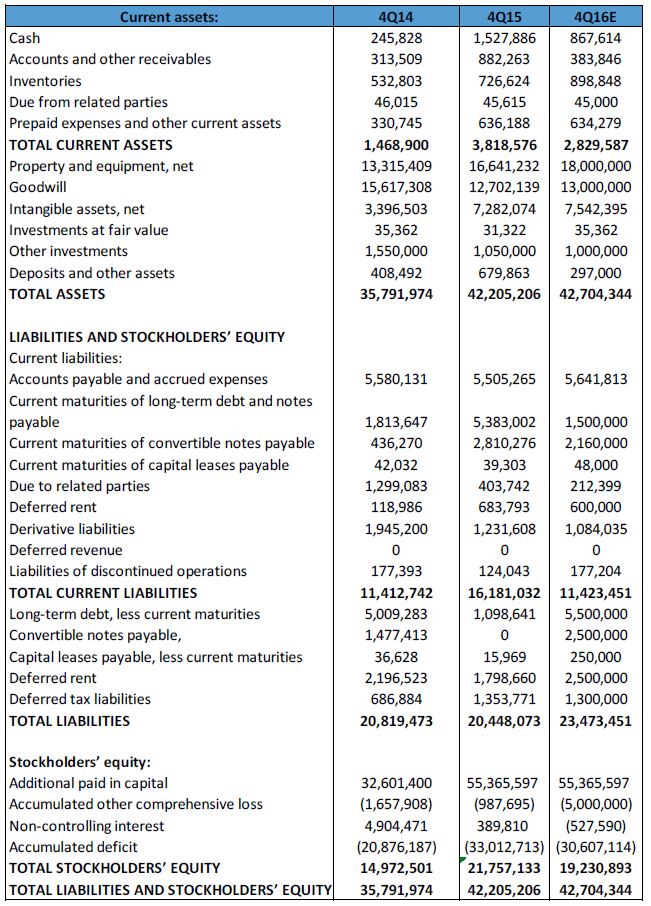

Balance Sheet Snapshot

| Cash (MRQ) | $1.5M |

| Debt (MRQ) | $8.2M |

Research Update

2015 Revenue Up 42% YOY; Company Poised for Restaurant Expansion in 2016

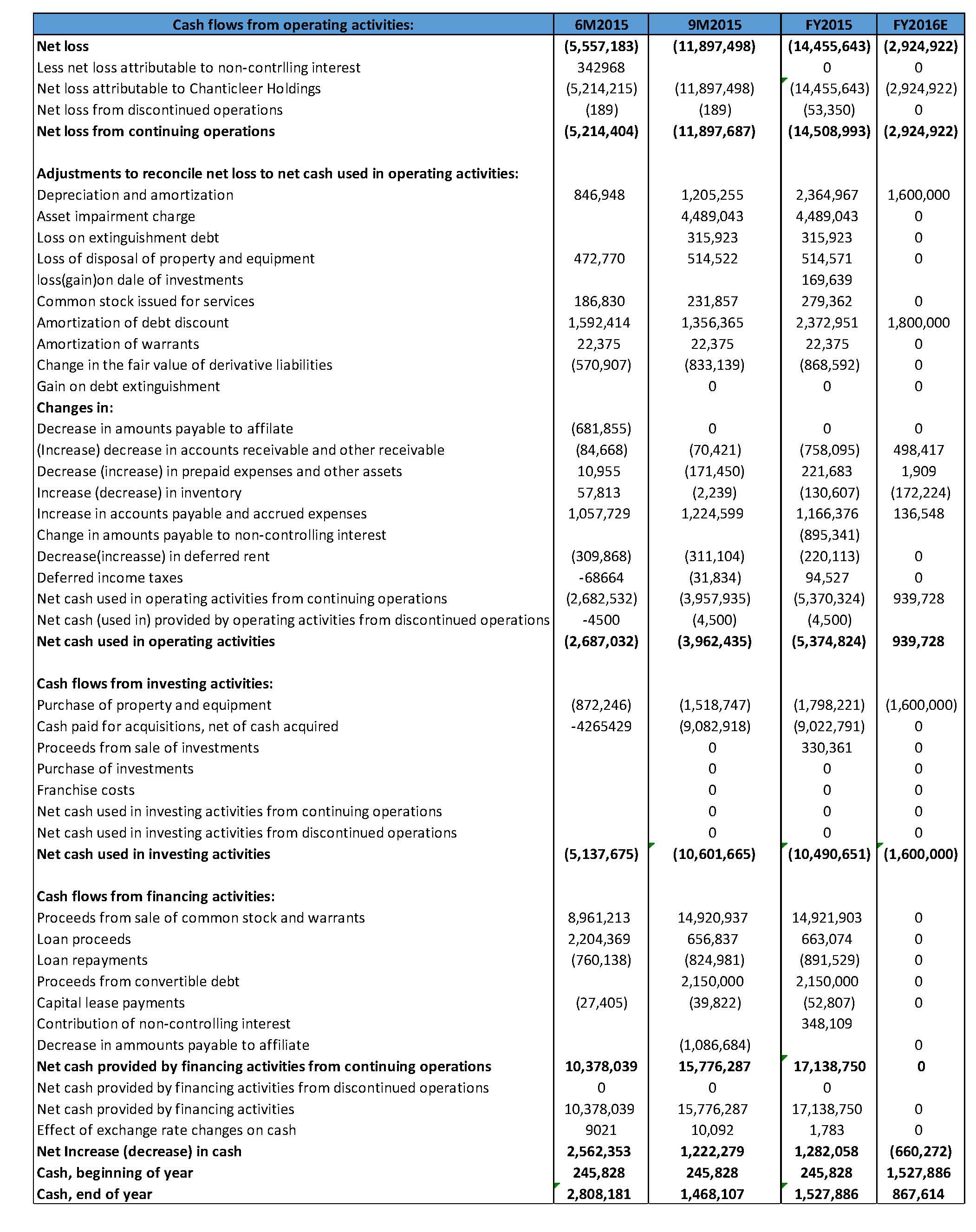

2015 Revenue Up 42% YoY; 4Q15 Revenue Up 47% YoY.HOTR reported $12.7 million in total revenues in 4Q15, a 47% increase YoY as compared to $8.6 million in 4Q14. 2015 revenue increased by 42% YoY to $42.4 million as compared to $29.8 million in 2014. Adjusted EBITDA was a loss of $380 thousand in 4Q15, a 71% YoY increase compared to a loss of $1.3 million in 4Q15 and annual adjusted EBITDA improved by 22%YoY to a loss of $2.7 million in FY2015 compared a loss of $3.3 million in 2014. The company also reported a net loss from continuing operations (which includes a one-time asset impairment charge of $4.5million related to administrative period in Australia) of $10 million or a loss of $0.86 per share in FY2015, compared to $5.7 million, or $0.87 per share in FY2014.

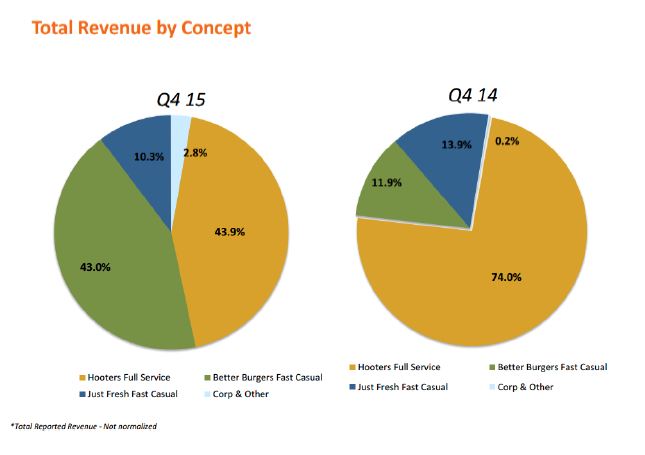

For 2015, the majority of revenue growth was attributable to acquisitions, which led to most of the growth in HOTR’s system wide store count from 26 to 62 stores in 2015. Revenue growth in 4Q15 was due primarily to a combination of expansion from acquisitions and increases in same store sales. Same store sales growth from HOTR’s better burger segment was particularly strong at 9.1%.

For 2016, we expect revenues to continue to increase with the Company shifting its focus from acquisitions to organic growth. The Company signed a letter of intent and entered into a financial partnership to open 10 little Big Burger stores in Seattle, WA. In addition, the Company also signed a franchisee deal to open 8 BGR- the burger joint locations in Washington, Baltimore, D.C. Market and 5 locations in Salt Lake City. With the successful completion of acquisitions and the integration of BGR The Burger Joint, BT’s Burger Joint, and Little Big Burger in 2015, we believe that HOTR will show improved EBITDA and lower net losses in 2016.

Revenues from the Company’s Better Burger Group increased 339% YOY. This strong performance is attributable to both growth in store count and increased same store sales. Company owned restaurants increased from six locations at the end of 2014 to twenty-seven locations in 2015. With the company opening up new stores in 2016, we believe that the better burger model will continue to grow in the restaurant industry with rapid growth of fast-casual restaurants and in addition to the company adding more franchisee deals to its better burger model.

HOTR is in the process of raising non-dilutive capital to fund expansion and reduce interest costs. The Company has several strategic initiatives to provide non-dilutive capital to support its operations and also refinance its existing high interest rates on notes payable and convertible debts. To support this initiative, the Company retained their existing UK investment bank for an up to £10 million bond offering of 7.5% interest only bonds. This is expected to close in 2Q16. In addition, the Company also entered into a letter of intent with a U.S. investment bank for up to $10 million in capital under the U.S. Government's EB-5 program. The Company has received approval for several potential sites for new restaurants in certain qualified geographic regions and are expected to complete their first EB-5 funding transaction in mid-2016. Finally, HOTR entered into a letter of intent directly with a U.S. investor to fully fund the opening of up to ten Little Big Burger restaurants in the Seattle area.

Valuation

We are valuing HOTR using a 0.85x EV/Sales multiple applied to our 2016 sales estimate of $59.05 million. This derives a target price of $2.02. A 0.85x EV/Sales multiple values HOTR near the low-end of its peer group and we believe that a discount is appropriate, given that HOTR is a smaller company relative to the majority of its comps, and the fact that the Company is just beginning to generate positive EBITDA.

Additional Information

Auditor: Cherry Bekaert LLP

Legal: Libertas Law Group, Inc.

Transfer Agent: Securities Transfer Corp.

About RedChip

RedChip Companies, an Inc. 5000 company, is an international small-cap research, investor relations, and media company headquartered in Orlando, Florida; with affiliate offices in New York, Pittsburgh, and Seoul. RedChip delivers concrete, measurable results for its clients through its extensive global network of small-cap institutional and retail investors. RedChip has developed the most comprehensive platform of products and services for small-cap companies, including: RedChip Research(TM), Traditional Investor Relations, Digital Investor Relations, Institutional and Retail Conferences, "The RedChip Money Report"(TM) television show, Shareholder Intelligence, Social Media and Blogging Services, and Webcasts. RedChip is not a FINRA member or registered broker/dealer.

RedChip Companies, Inc. research reports, company profiles and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law, RedChip Companies, Inc., our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles or in other investor relations materials or presentations that it publishes electronically or in print. We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov. Chanticleer Holdings (HOTR) is a client of RedChip Companies, Inc. HOTR agreed to pay RedChip Companies, Inc. a monthly cash fee for 3 months of RedChip investor awareness services.

Additional information about the subject security or RedChip Companies Inc. is available upon request. To learn more about RedChip’s products and services, visit http://www.redchip.com/corporate, call 1-800-RedChip (733-2447), or email info@redchip.com.

Company Contact Info:

Chanticleer Holdings, Inc.

7621 Little Ave – Suite 414

Charlotte, NC 28226

Tel: 704-366-5122

Investor Contact Info:

RedChip Companies, Inc.

1017 Maitland Center Commons Blvd.

Maitland, FL 32751

(407) 644-4256

www.redchip.com