CÜR Media, Inc.

(OTCQB: CURM)

RESEARCH REPORT

February 19, 2016

Stock Information

Market Data

| Fiscal Year | December |

| Industry | Streaming Music |

| Market Cap | $14.60M |

| Price/Earning (ttm) | N/A |

| Price/Book (mrq) | 37.8x |

| Price/Sales (ttm) | N/A |

| Insider Ownership | 36.9% |

| Shares Outstanding | 2.4M |

| Equity Float | 1.4M |

| Avg. Volume (3 mo.) | 2,359 |

Income Statement Snapshot

| Revenue (TTM) | $0.0M |

| Net Income (TTM) | ($7.9M) |

Balance Sheet Snapshot

| Cash* (MQR) | $2.1M |

| Debt* (MQR) | $2.2M |

*Includes gross proceeds from convertible debt issuances between 10/20/15 - 1/14/16

Research Update

CÜR Commercial Launch Expected in the Near-Term

Months of beta testing prepares CÜR for commercial launch. CÜR Media began beta testing for its next-generation social music service, CÜR, in April and May 2015. This beta testing occurred across all major platforms (Apple iOS, Android, and web-based platforms). CÜR recently completed, in aggregate, convertible note financings of $2.1 million, which was led by management and key music industry personnel. CURM has also hired additional executive personnel and entered into key strategic partnerships. We expect the Company to complete an additional, larger capital raise for the commercial launch of CÜR. We expect CÜR to commercially launch sometime during 1H16.

CURM has signed licensing deals with the big 3 music labels.The big 3 music labels are Warner Music Group, Universal Music Group, and Sony. These deals give CÜR access to a robust music library that the Company will need to be successful. At launch, CÜR plans to have 5-10 million songs available in its library (where in the range this falls is subject to completed deals with independent music labels). Post-launch, CÜR plans to have over 20 million songs available in its library.

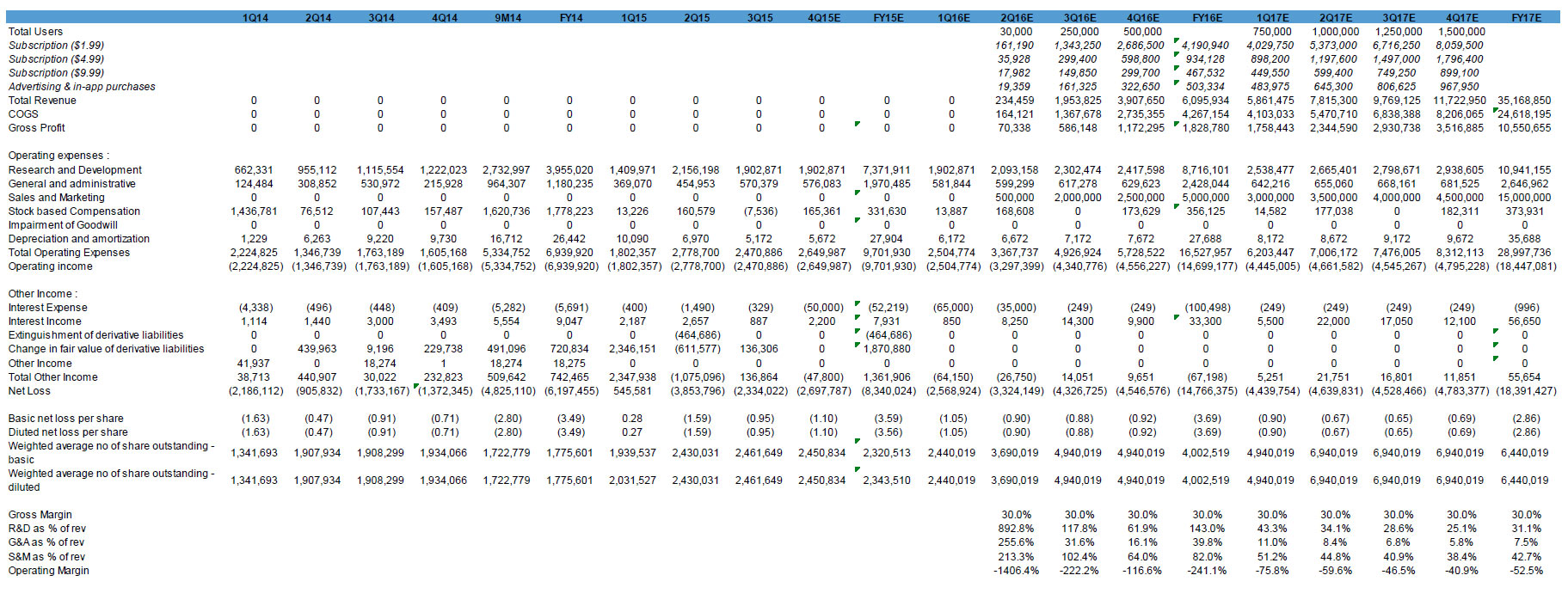

CÜR will have multiple revenue streams and subscription tiers. CÜR plans to have multiple subscription tiers, along with targeted advertising streams and content sales (music, concert tickets, merchandise). These revenue streams are as follows:

CÜR’s first subscription level will include tiers at $1.99 per month and $4.99 per month. This will include a service similar to that provided by free, ad-supported/interruptive services provided by free internet music streaming stations (CÜR will not be interrupted by ads). There will also be a limited on-demand offering, known as a user’s CÜR8. This will allow users to have 8 songs on-demand in their online music profile, which can be swapped out each day. Social sharing services are also offered, including sharing photos and short personal videos in conjunction with personal playlists/songs. Users can also follow each other and listen to each other’s CÜR8s. In our opinion, this subscription tier will receive the most interest from users and is where we believe CURM derives its competitive advantage. We believe the majority of revenue will be earned from this subscription level.

A third subscription tier will also be offered between $9.99-$12.99 per month. This will give users on-demand access to CÜR’s entire music collection, along with lyrics and the ability to download and listen to music offline.

Additional revenue is expected to be earned from personalized advertising (designed not to interrupt a user’s listening experience), and the sale of music, concert tickets, and merchandise. CURM plans to target ads and products to users based on their prior listening habits. We believe that these revenue streams could generate solid results, particularly as CURM aggregates more data over time.

On demand music services continue to add paid subscribers and users; valuations are significant. Spotify currently has at least 20 million paid subscribers (unofficial estimates are closer 25 million), and has approximately 75 million active monthly users. Spotify’s most recent valuation was at approximately $8.5 billion, or approximately $425 per paid subscriber, off its most recent fundraising of $526 million. Apple’s recently released music streaming service has over 10 million paying subscribers. French service Deezer has approximately 3.8 million paying subscribers and 16 million total users, and its recently planned IPO (which has been pushed to a later date) valued Deezer at approximately $1.25 billion, or approximately $330 per paid subscriber.

Australian music streaming company Guvera has reported that it is being valued at approximately $1 billion on the back of a recent pre-IPO fundraising of A$100 million ($72.2 million). Guvera currently has 15 million users, with 6.5 million users in India (the vast majority of these users do not pay for the service).

The music streaming service industry is becoming increasingly competitive, as a result of the substantial market size. This is indicated by the strong valuations given to on-demand streaming music companies. We believe that CURM’s social music sharing services (through its CÜR8music profile), provide a strong differentiating factor, particularly when considering the significant popularity and user bases of other social media companies.

Valuing CURM at $18.00 per share, based on a 2Q17 user base of 1 million and a value per subscriber of $165. We are valuing CURM per paid subscriber. We are projecting CURM to have 1 million paid subscribers by 2Q17. Given that the majority of the projected subscribers are coming in at a cheaper price point than Spotify and Deezer’s monthly subscription price, we are valuing CURM at $165 per paid subscriber. We then apply a discount rate of 25% to this figure over 1.25 years, reflecting that this subscriber base is projected to be achieved by 2Q17. Applying this figure to CURM’s projected 1 million subscribers and dividing by projected 2Q17 shares outstanding of 6.9 million gives a target price of $18.00.

We believe the current lack of a social music service and the strong valuations given to streaming music companies provide a huge opportunity for CÜR Media. Other social media companies command significant valuations, including Facebook ($297 billion market cap), Twitter ($12.5 billion market cap), Instagram (valued at $35 billion by Citigroup analysts, acquired by Facebook for $1 billion in 2012), Pinterest ($11 billion private valuation), and Snapchat ($12-$16 billion private valuation).

Additional Information

Auditor: Friedman, LLP

Legal: CKR Law LLP

Transfer Agent: VStock Transfer, LLC

CÜR Media, Inc.

2217 New London Tumpike

South Glastonbury, CT 06073

Investor Contact Info:

RedChip Companies, Inc.

1017 Maitland Center Commons Blvd.

Maitland, FL 32751

(407) 644-4256

www.redchip.com